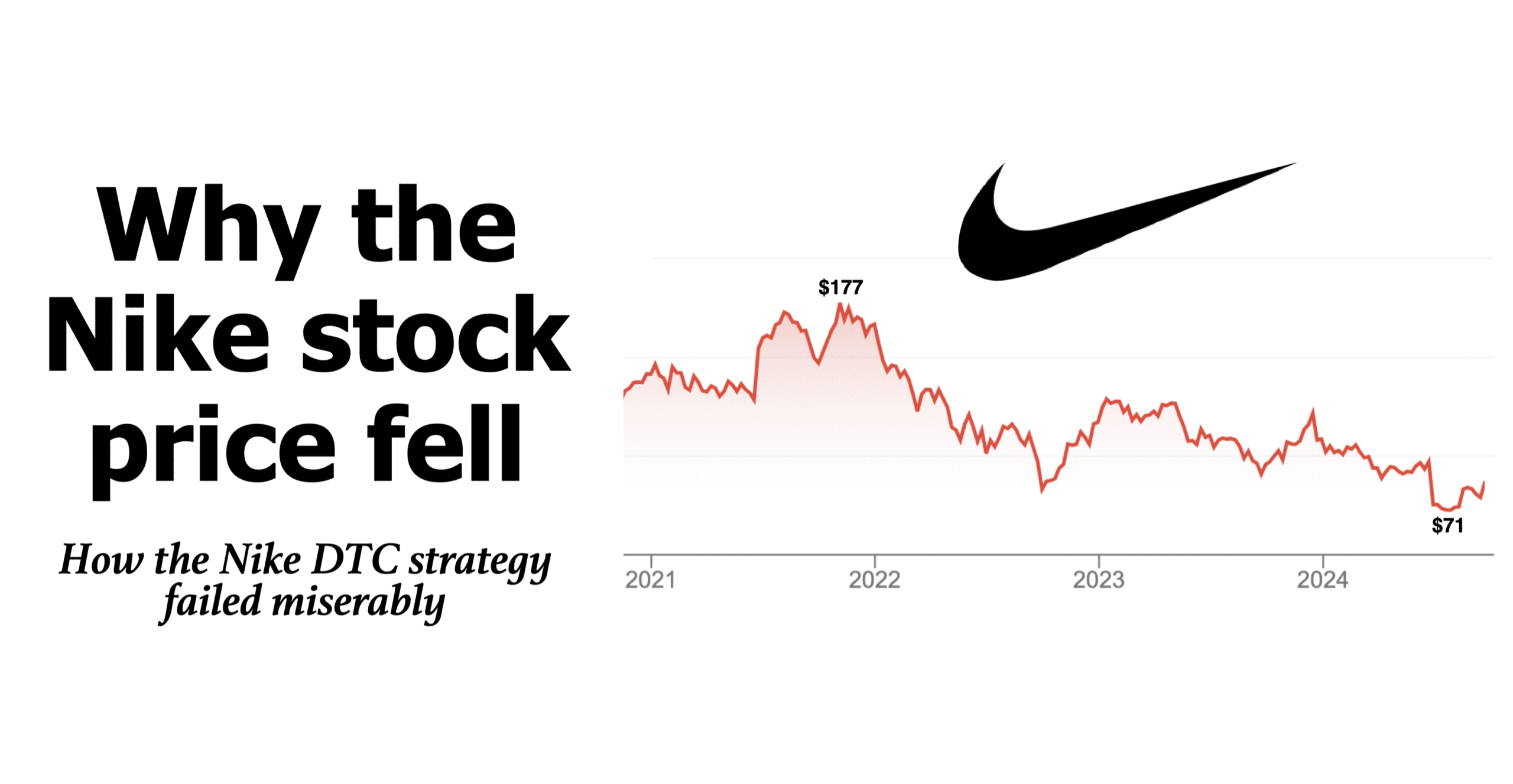

Nike’s stock price has dropped 25% in 2024 and has been cut in half since its high in 2021, largely due to the company’s missteps with its DTC strategy (direct-to-consumer.) In an effort to cut out middlemen and capture higher margins, Nike reduced its support for traditional retailers, focusing instead on selling through its own stores and digital platforms. While DTC initially promised to boost profits, the strategy lacked the necessary infrastructure and market understanding to succeed. Nike has replaced their CEO, and the market wants a new strategy. Right away, the Nike Stock Price jumped 8%. But time will tell if the new CEO can get them out of their mess.

What went wrong for Nike - Table of Contents

What went wrong - The Nike DTC strategy

Isolate the variables to explain the declining Nike sales

Too many marketers see poor results and start believing everything is wrong. Then, they fix what isn’t broken.

The best marketers use analytics to isolate the variables. Over the last few months, I’ve heard many explanations that have nothing to do with what happened. Nike’s product innovation is falling behind, their latest TV ads suck, they picked the wrong athletes, or globalization caught up to them. Some of that may be true, but if we isolate one variable at a time, we can fix what needs fixing. In this case, the shift in the Nike DTC strategy has had the most significant impact on the declining Nike sales.

Nike wanted to keep all the margin, instead of giving it to retailers

A greedy bet on DTC In 2017, Nike slashed several key retail partnerships, including Zappos and Dillard’s, to drive more sales directly through its own platforms, like the SNKRS app and Nike stores. This approach made sense at first, given that controlling the consumer relationship could lead to higher margins. However, Nike underestimated how much consumers valued the physical retail experience by cutting back on wholesale partners. Traditional retailers helped customers compare brands and offered a community-driven shopping culture deeply ingrained in sneaker culture.

The Nike DTC strategy underestimated the impact of in-person shopping and the market reach it provided

Nike’s focus on DTC isolated its loyal customer base, particularly sneakerheads who felt disconnected from the brand’s online-focused launches. The SNKRS app, which relied on raffles, frustrated consumers who consistently missed out on hyped releases. As frustration grew, customers turned to competitors like New Balance, On, and Hoka, which stepped in to fill the void with innovative products and widespread retail availability.

By shifting its DTC strategy, Nike dramatically reduced its reach. The company was ill-prepared for the logistical challenges of this shift. Meanwhile, other brands continued to innovate and focus on traditional retail channels. As a result, Nike’s revenue took a hit, especially in key markets like China, where demand for Nike products softened. The strategy’s failure to capture growth led to a major decline in stock value.

The Market Analysis - Nike results

Too many marketers are not taking the time to analyze their data. There is no value in having access to data if you are not using it. The best brand leaders can tell strategic stories through analytics.

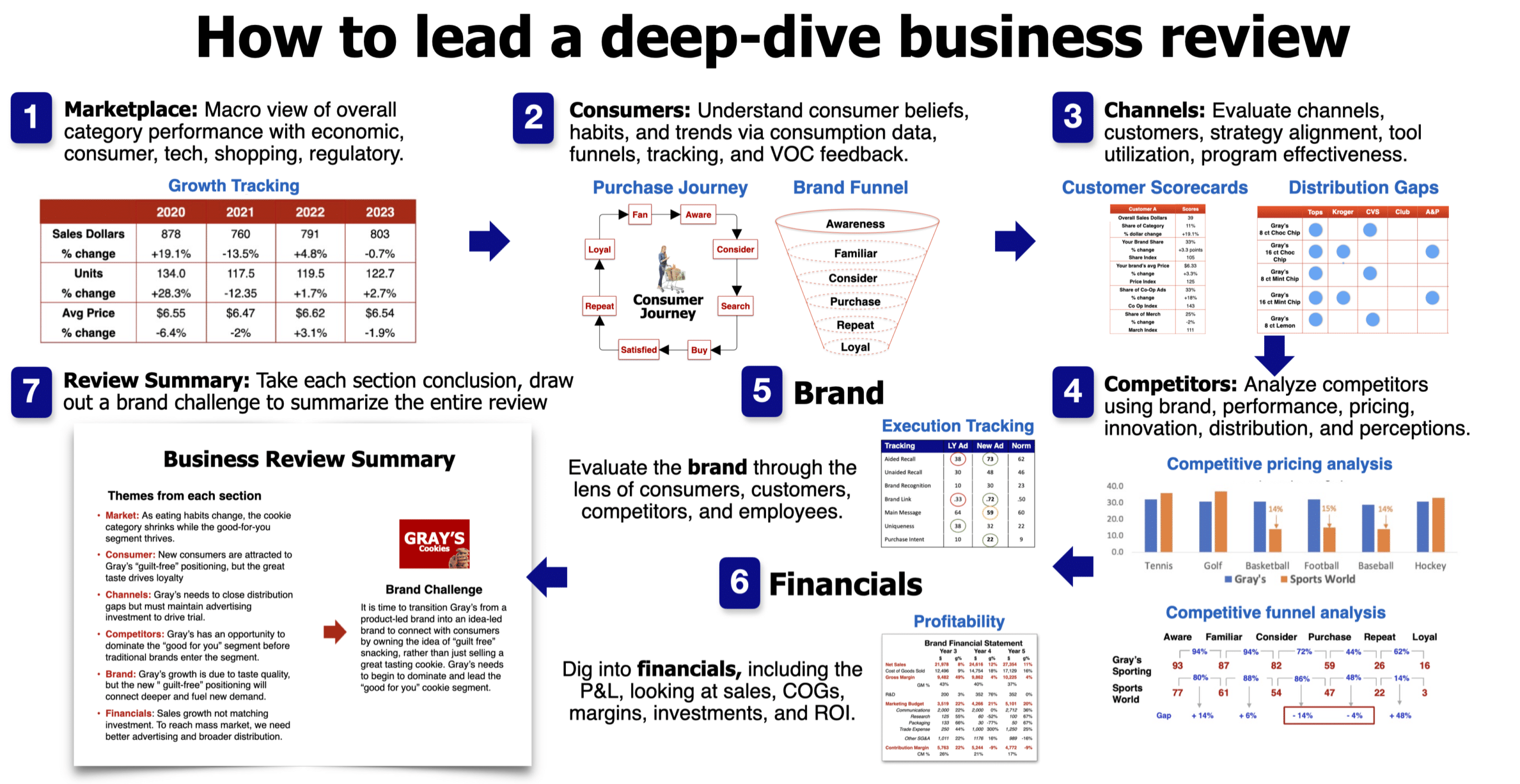

Marketers need to conduct a deep-dive business review at least once a year on your brand. Otherwise, you are negligent of the brand, where you are investing all your resources. Dig in on the five specific sections—marketplace, consumers, channels, competitors, and the brand. The Nike DTC strategy should come out of the deep-dive. Then, add a deep look at the financials to complete the review including a look at the Nike Stock Price.

To illustrate, click on the diagram above to see how to leed a deep-dive business review to assess the Nike stock price.

Deep-dive review that explains the Nike results

To fully understand Nike’s challenges, let’s examine its position in key areas: marketplace, consumers, channels, competitors, brand, and financials.

Marketplace

The global athletic footwear market has evolved, with emerging brands like On and Hoka growing rapidly and cutting into Nike’s market share. Traditional players like Adidas have also reemerged as strong competitors. The post-pandemic economic environment has softened, with consumer demand declining, especially in key growth markets like China.

Consumers

Nike’s core consumer base became frustrated with the SNKRS app and the DTC model’s reliance on online sales and raffles. Sneaker culture, built around community, was disrupted. Nike underestimated how much these shoppers valued the in-store retail experience and the ability to compare brands in a physical space.

Channels

Nike cut back on traditional wholesale channels, including partnerships with big retailers like Foot Locker. While focusing on their own stores and digital platforms, they underestimated the operational complexity and expertise required to execute this efficiently. The impact was felt as sales channels became limited, reducing overall product reach.

Competitors

Competitors seized the opportunity to fill the gaps Nike left behind. Brands like New Balance, On, and Hoka focused on innovation and niche markets, winning over disenchanted Nike customers with fresh designs, quality, and availability in retail stores where Nike products became scarce.

Brand

Nike’s brand perception took a hit. Once known for its innovation and community-driven culture, the shift to DTC made Nike appear disconnected from its roots. The brand became perceived as corporate and greedy, alienating both long-time fans and new buyers. Not lining everything up will make people doubt what you are good at. For example, the declining Nike stock price has nothing to do with their advertising.

Financials

Nike’s failure to generate sufficient revenue and a bad Nike DTC strategy led to a significant drop in earnings and a declining Nike stock price. The company’s stock has fallen 50% since its 2021 high, driven by weaker-than-expected sales, especially in China, and soft demand across global markets.

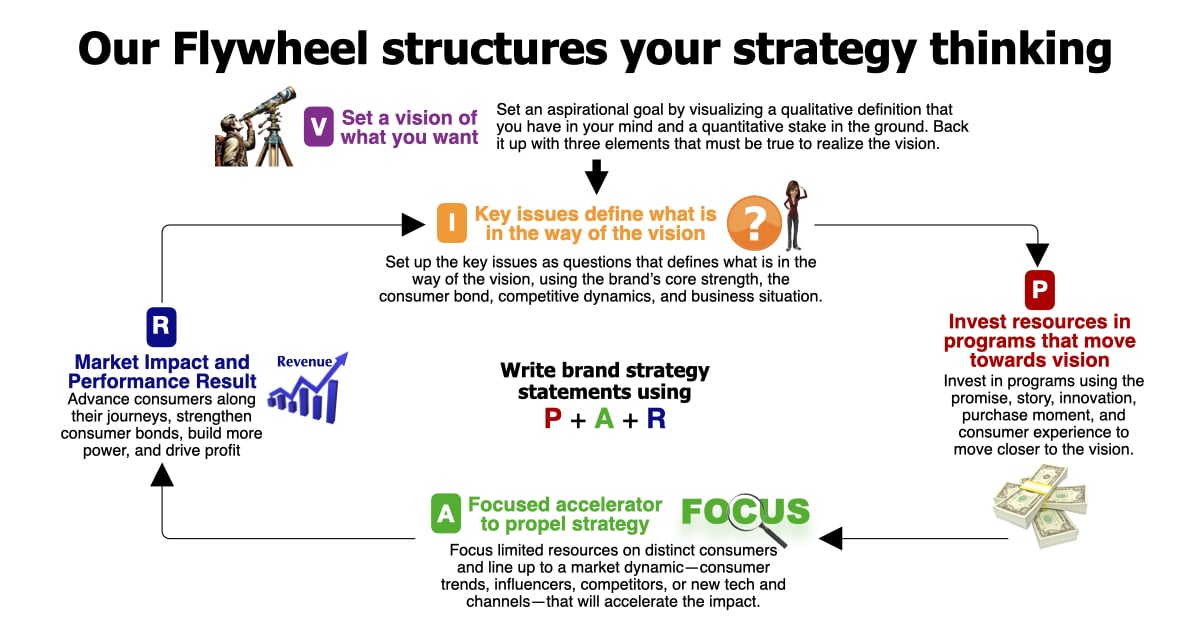

Using our strategic thinking tool to explain the bad Nike DTC strategy

V: Your vision is a magnet to pull everyone toward your ideal future.

A strategy starts with a vision that sets aspirational stretch goals for the future that should be linked to a clear result or purpose. The vision should steer everyone who works on the brand to focus on finding ways to create a bond with your consumers that will lead to power and profit beyond what the product alone could achieve. Imagine it is five or ten years from now, and you wake up in the most fantastic mood.

Visualize a perfect future and write down the most critical milestones you must achieve. Consider words that will inspire, lead, and steer your team toward your vision. If the vision is too close to your current situation, it will have no impact. If the vision is impossible, it will fail to connect with the team.

To illustrate, click on the diagram above to see how to write a Nike DTC strategy that will increase the Nike stock price.

I: Key Issues define what is in the way of achieving the vision.

Brands must examine the gap between the current trajectory and their aspiring vision. We use interruptive questions that frame the issues regarding what is in the way of achieving what you want. By raising those issues early on, you can focus the team on the significant problems to solve on the pathway to the stated vision. Keep asking questions at this stage.

P: Invest in programs that move towards the vision.

Invest your limited resources—money, people, time, and partnerships—in strategic programs to help close the gap between your current projection and the aspirational vision. From a brand viewpoint, align your investment to reinforce the brand promise, communicate the brand story, close the deal at the purchase moment, launch new product innovation, or create an ideal consumer experience. These investments line up to deliver a brand’s consumer touchpoints so that you will tighten the bond with consumers. The investment will result in a more powerful, faster-growing, and profitable brand.

To illustrate, click on the diagram above to see how to write a Nike DTC strategy that will increase the Nike stock price.

A. Focused accelerator to propel strategy

Identify who you are talking to and whether you will focus on new category consumers, competitive consumers, or current consumers. Focus on those consumers most motivated by what you offer and use your marketing investment to move them in ways that generate more profit than the original investment. Invest over the long term to build the target over time.

A brand should target new category consumers to reach younger consumers at the entry point of using the category. When you have a superiority over a competitor, you can target their users to steal market share. When a brand wants to drive usage frequency or share of wallet, it should target its users.

Then, look for an accelerator already happening in the market that will help you explain why you think your investment will work harder. Those accelerators could be consumer trends, influencer opinions, competitors, new technology, or new channels. The accelerator provides proof that the investment is worth it.

R. Breakthrough market impact that leads to a performance result

A smart strategy advances consumers along their journeys, strengthens consumer bonds, builds more power, and drives profit. A breakthrough market impact involves advancing consumers along their purchase journeys, moving them from awareness to consideration to purchase by using the right trigger at each stage. And then onto repeat, loyalty, routines, and becoming a brand fan who influences others.

Driving Power.

Great strategy results in a shift in positional power in the marketplace, moving your brand toward your vision. Brand power is stored energy that can be used for future profits. As we showed in the previous chapter, a brand can become powerful compared to the consumers it serves, competitors it battles, channels it sells into, suppliers who make the products, influencers in the market, and employees who work for the brand.

Driving Profits.

The ultimate goal of any brand strategy is to drive profit through premium pricing, trading consumers up on price, finding a lower cost of goods, using lower sales and marketing costs, stealing competitive users, getting loyal users to use more, entering new markets, or finding new uses for the brand. As an investment manager, when you provide a profit greater than the investment, the CFO will tap on your door with more money and say, “Do it again.” And that’s why I use a flywheel to show our brand strategy.

Vision:

- Nike aimed to own the consumer relationship through DTC sales, reducing reliance on traditional retail partners.

Key Issue:

- The assumption that customers would fully embrace DTC proved incorrect. Nike’s infrastructure and operational inefficiencies couldn’t handle the shift, and the company lost touch with consumer behavior and retail preferences.

Program Investment:

- Nike heavily invested in its own apps and stores, cutting back on traditional retail partnerships and limiting product access for loyal customers who preferred shopping in stores.

Focused Accelerator:

- Nike targeted its core customer base through digital channels, believing this audience would prefer a direct relationship. This strategy backfired as customers turned to competitors offering more accessible retail experiences.

Expected Market Impact:

- The goal was to improve margins and deepen consumer loyalty. Instead, the lack of infrastructure and operational missteps alienated Nike’s fan base, driving down sales and cutting the Nike stock price in half.

The road to recovery for the Nike stock price

Fixing the Nike DTC strategy and positively impacting the Nike results

To regain its market position, Nike needs to rethink its strategy, blending both direct-to-consumer and traditional retail channels. This balance is key to winning back consumers and expanding the brand’s reach.

Vision:

- Re-establish Nike as the leader in athletic innovation and consumer accessibility, balancing DTC and retail partnerships.

Key Issue:

- Rebuild strong retail relationships while optimizing the Nike DTC strategy to improve product accessibility and better understand consumer preferences.

Program Investment:

- Focus on investing in both retail partnerships and digital infrastructure to provide a seamless omnichannel experience for consumers. Nike needs to go beyond the Nike DTC strategy and look at an overall Nike sales strategy.

Focused Accelerator:

- Target both sneaker culture enthusiasts and mainstream consumers who prefer a blend of online and in-store experiences. By balancing both channels, Nike can reconnect with lost consumers and attract new ones. Combining DTC with retail partnerships gives Nike the broad market reach it needs while maintaining higher margins in direct sales.

Expected Market Impact:

- Increased customer satisfaction, broader market penetration, a revitalized brand image, and a return to steady stock growth. As a result, we would expect to see an increasing Nike stock price.

John Donahoe was the wrong CEO for the Nike culture

The CEO was a mismatch for the Nike culture

John Donahoe’s departure as Nike’s CEO highlights a key lesson for business leaders: aligning leadership strengths with the company’s core focus is crucial. Donahoe’s background in e-commerce and supply chain was valuable, but it didn’t match Nike’s design-driven culture. Nike thrives on product innovation, blending performance and style. This requires a leader who not only understands design but also fosters creativity within teams. Unfortunately, Donahoe’s expertise lay outside the areas Nike needed most—innovation and marketing.

From the start, analysts questioned whether a former tech executive was the right fit for Nike’s design-centric brand. His lack of experience in product innovation and consumer trends stood out, and he couldn’t fully step into the role of chief enabler for Nike’s designers. For a company like Nike, which lives and breathes cutting-edge design, the CEO needs to personify that focus at every turn.

The best brands have great people behind the brand

This story reminds us that the best leaders aren’t just skilled—they are aligned with the company’s mission. Whether your business focuses on design, production, delivery, or service, the CEO must embody the organization’s values, culture, and strategic direction. Leadership isn’t just about general competencies but about having the right strengths for the company’s unique focus. The Donahoe era at Nike shows what happens when that alignment is missing.

When considering leadership roles, it is vital to ensure your strengths align with the organization’s core mission—otherwise, even the most talented executives can fall short.

The new Nike CEO is a Nike insider

As Nike embarks on its recovery, the new CEO is a 30-plus-year Nike lifer who started as a Nike intern. He certainly knows the culture and the importance of the retail world for the Nike brand.