The analytical brand leader wins through insight. I want to show you the principles of smart analytical thinking, so you can dig deep and draw out conclusions to help set up your brand’s key issues, to steer the strategic brand plan.

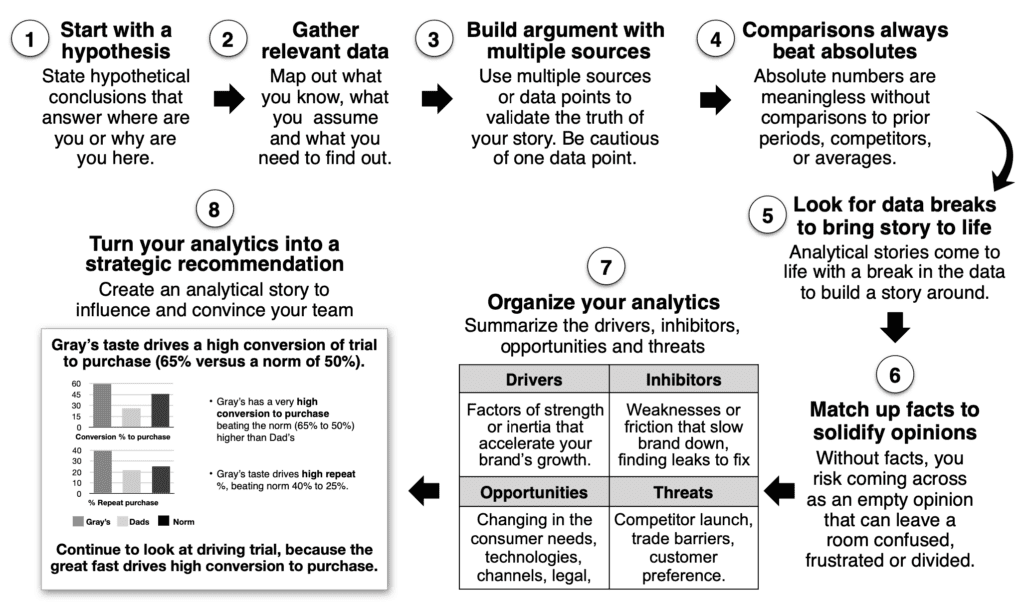

Your analysis should start with a hypothesis, then gather data to use facts to solidify or refute your opinion. Make sure you use multiple data sources, to draw out comparisons over absolutes to find data breaks that help bring an analytical story to life. Use summary tools to consolidate and organize your thinking to build-out recommendations that can convince management and steer the team. You owe your brand a deep-dive business review at least once a year. Otherwise, you are negligent about your brand.

The best analytics is hidden beneath the surface

When you operate only at the surface level, you miss out on what’s going on beneath your instinctual observations. To go deep, you need to look at everything, including the category you play in, the consumers you serve, the distribution channels you sell through, your main competitors, and the underlying health of your brand. The deep-dive business review should kick-off your brand planning process, ensuring your plans are addressing the right issues and that you have the knowledge to make informed decisions on your brand.

Moreover, you owe your brand a monthly report to track how the business is doing throughout the year. While these reports may feel tedious to write, the 3-4 hours it takes to dig in is a great discipline to help you maintain the touch-feel of managing the business results of the brand. As you go through the process every month, it is a great way to improve your analytical skills.

The eight principles of analytical thinking

Start with a hypothesis

You don’t start with the facts; you start with a conclusion based on your instincts of knowing your business. Then, gather the facts to solidify, change, or refute your conclusion.

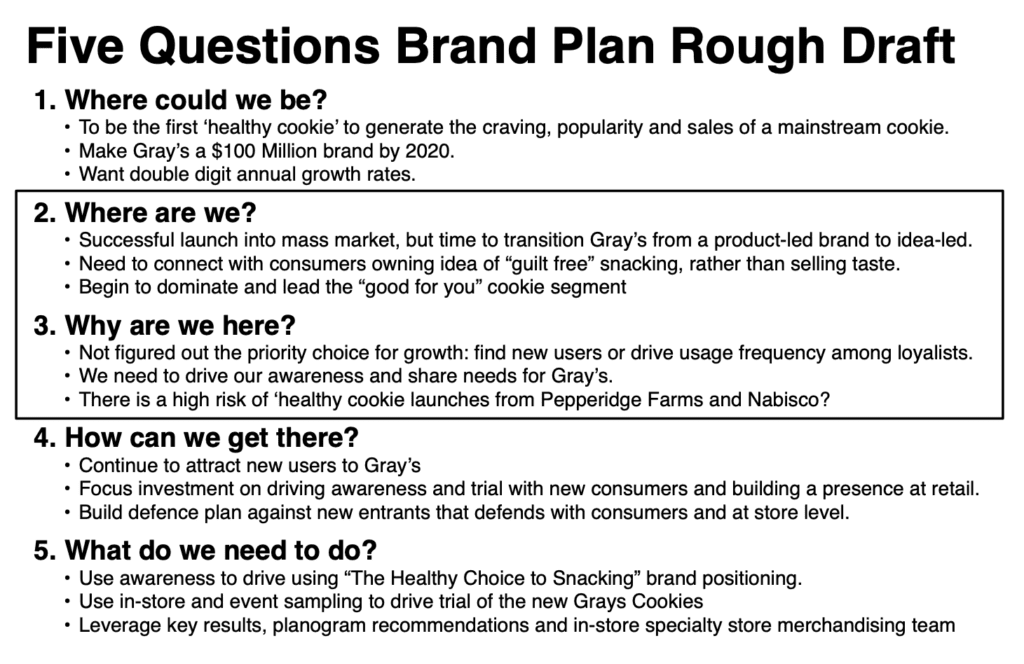

Try to get your head out of the day-to-day grind and think about the significant issues getting in your way. Start any analytic process with five questions that answer where do you want to be, where you are now, why are you here, how can we get there, and what do we need to do. These questions provide a summary of any strategic plan with a vision, analysis, key issues, strategies, and tactics. Your analytics should start with a hypothesis that zeroes in on two of these questions to answer where your brand is today, and why it is there.

Use our four questions of our Strategic ThinkBox and assess how your brand’s core strength is showing up in the marketplace, signs of how tight your relationship is with consumers, how well you are battling competitors and what is your brand’s situation. To assess the situation, you can think about the factors currently driving and inhibiting your brand’s growth, and then lay out the future threats and untapped opportunities.

Take it all in and narrow down to a hypothesis of what you think are the three significant issues that explain your brand’s situation.

Gather relevant data

An in-depth analysis requires slower thinking time, so you don’t misjudge the situation. The best Brand Leaders know when to be a strategic thinker and when to be an action thinker. Strategic thinkers see “what if” questions before seeing solutions, mapping out a range of decision trees that intersect and connect by imagining how events will play out. They take time to reflect and plan before acting, helping you move in a focused, efficient fashion. They think slowly, logically, always needing options, but if you go too slow, you will miss the opportunity window. An excellent tool to get you thinking in terms of questions:

- First, what do you know? Forces you to be fact-based, and you know it for sure.

- Second, what can you assume? Use your knowledge to draw conclusions that bridge between fact and speculation.

- Next, what do you think? Based on facts and assumptions, you should be able to say what we think will happen.

- Then, what do you need to find out? There could be unknowns still.

- Finally, what are you going to do? It is the action that comes out of this thinking.

This type of thinking will set you up for what data you should be looking to fill the gaps in your argument.

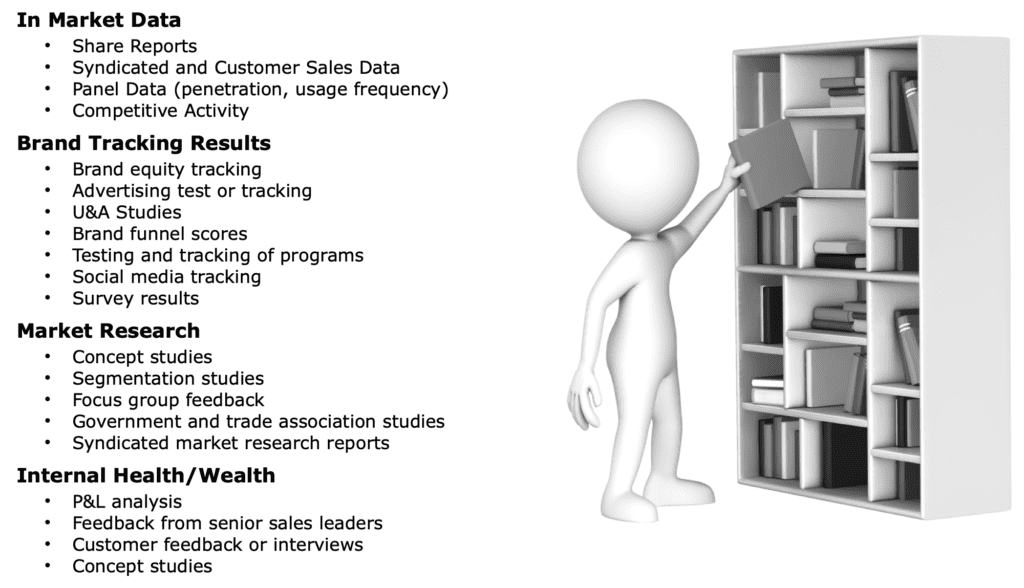

Sources of brand data to dig into

As the brand leader, you should always be tracking your market share trends over the last five years, last 12 months, last 12 weeks, and then broken out by segment, size, flavors. Create brand development scores that index your brand’s performance that is broken out by the business, customer type, markets, or regions.

You should track your brand funnel data regularly, looking at awareness, consideration, search, trial, purchase, usage, repeat, loyal, comparing the funnel scores to prior periods and competitors. You should know your consumer purchase behavior, looking at penetration, usage frequency, and share of requirements. When it comes to program tracking, look at aided, unaided awareness, brand link, message recall, and purchase intention scores. The gaps you find with this type of data set up issues to use in your brand plans.

You also have to know the profitability of your brand, identifying the 5-year compound annual growth rates (CAGR) gross margins, cost of goods, consumer and trade spend, and your net margin.

Our Beloved Brands playbook and B2B Brands playbook go into depth on how to use these types of analytical tools to lead your deep-dive review on your business.

Build your argument with multiple sources

Avoid taking one piece of data and making it the basis of your entire brand strategy. Make sure you see a real trend that continues over time. Dig around until you can find a convergence of data that leads to an answer. Multiple sources and multiple data points should back every analytical story.

Ten probing questions to assess your brand’s performance:

- First, what consumer benefit can you win with, which is ownable, unique, and motivating for consumers?

- Then, what is your biggest gain versus prior periods? What is your biggest gap?

- What is your market share? Regionally? By channel? Where is your strength? Where is your gap?

- How are you performing on key brand tracking data? Penetration? Frequency? Sales per buyer or per trip?

- What are your brand’s scores on the brand funnel?

- How is your program tracking data doing? Where could you improve?

- How far can you “stretch” your brand into other opportunities?

- What is your current operating model?

- What is your culture? Do you have alignment with the brand story and your employees?

- Finally, what is the innovation process and capability of the organization?

Ten financial questions to assess your brand’s worth:

- First, what is your brand’s compound annual growth rate (CAGR)? Explain the ups and downs over the past five years.

- What are your gross margins and contribution margins over the last five years? Can you break it out by product line? Is there more pressure from the price or the cost of goods?

- What is your brand’s marketing budget breakout? Variable direct costs versus indirect fixed dollars? What is the break between media and creative production? Consumer spend versus trade spend?

- Have you completed any pricing elasticity studies? What did you learn about your brand? If you did increase your price, what did you see in the marketplace?

- How is your brand’s overall strategy impacting your brand’s profits? And, how do your decisions on your brand’s core strength, consumer connection, competitive pressures, and situation impact your financials?

- How are your current brand/business performance metrics, brand’s market goals, and financials linked?

- Over the past five years, what are the programs that drive the highest and lowest ROI?

- How does your business model impact your overall profit? What are you focusing on right now?

- What are your forecasting error rates? Is there a seasonality impact? How do economic factors impact your brand’s financials? How reasonable are your inventory levels?

- Finally, what financial pressures do you face on an annual or quarterly basis?

How to conduct a deep-dive business review to uncover brand issues

Too many marketers are not taking the time to dig in on the analytics. There is no value in having access to data if you are not using it. The best brand leaders can tell strategic stories through analytics.

Conduct a deep-dive business review at least once a year on your brand. Otherwise, you are negligent of the brand, where you are investing all your resources. Dig in on the five specific sections—marketplace, consumers, channels, competitors, and the brand—to draw out conclusions to help set up your brand’s key issues, which you answer in the brand plan.

The five areas of your deep-dive business review

- Marketplace: Start by looking at the overall category performance to gain a macro view of all significant issues. Dig in on the factors impacting category growth, including economic indicators, consumer behavior, technology changes, shopper trends, and political regulations. Also, look at what is happening in related categories, which could impact your category or replicate what you may see next.

- Consumers: Analyze your consumer target to better understand the consumer’s underlying beliefs, buying habits, growth trends, and critical insights. Use the brand funnel analysis and leaky bucket analysis to uncover how they shop and how they make purchase decisions. Try to understand what they think when they buy or reject your brand at every stage of the consumer’s purchase journey. Uncover consumer perceptions through tracking data, the voice of the consumer, and market research.

- Channels: Assess the performance of all potential distribution channels and the performance of every major retail customer. Understand their strategies and how well your brand is using their available tools and programs. Your brand must align with your retail customer strategies.

- Competitors: Dissect your closest competitors by looking at their performance indicators, brand positioning, innovation pipeline, pricing strategies, distribution, and the consumer’s perceptions of these brands. To go even deeper, you can map out a strategic brand plan for significant competitors to predict what they might do next. Use that knowledge within your brand plan.

- Brand: Analyze your brand through the lens of consumers, customers, competitors, and employees. Use brand funnel data, market research, marketing program tracking results, pricing analysis, distribution gaps, and financial analysis. Focus on managing your brand’s health and wealth.

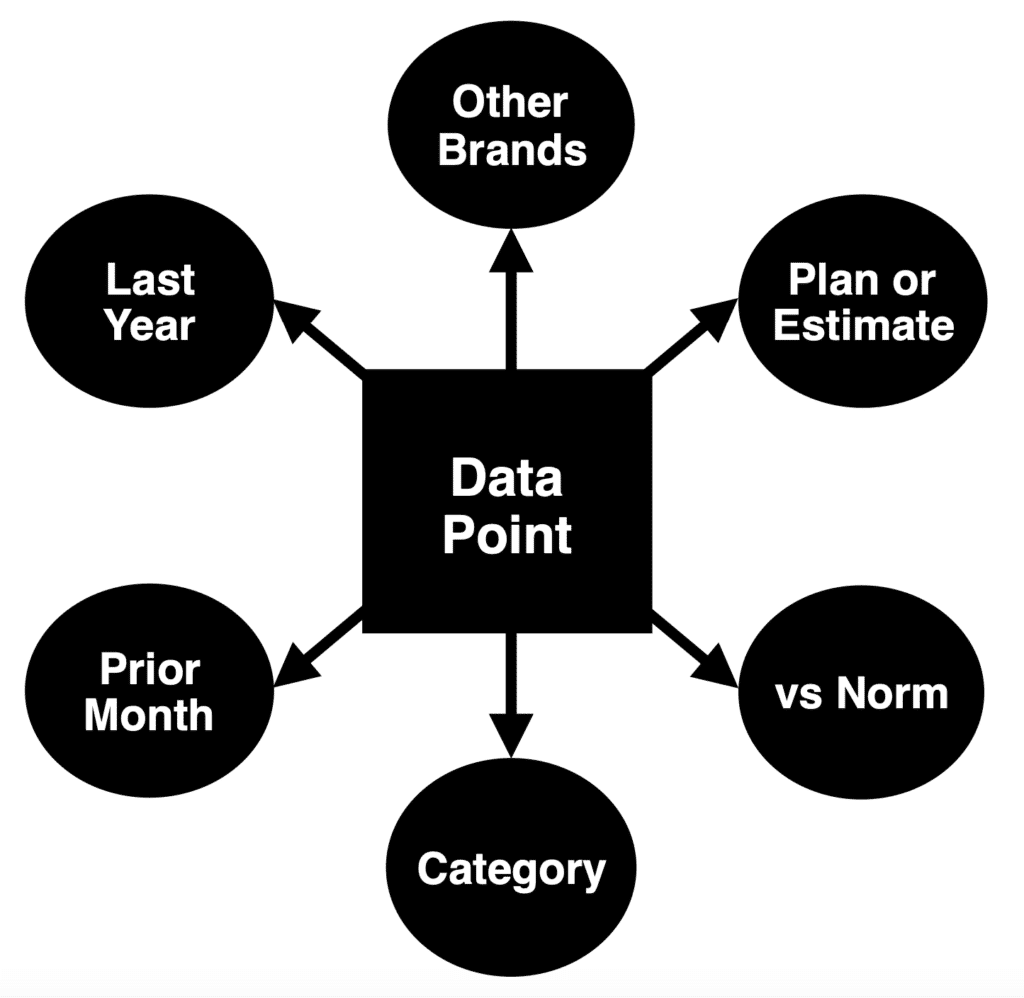

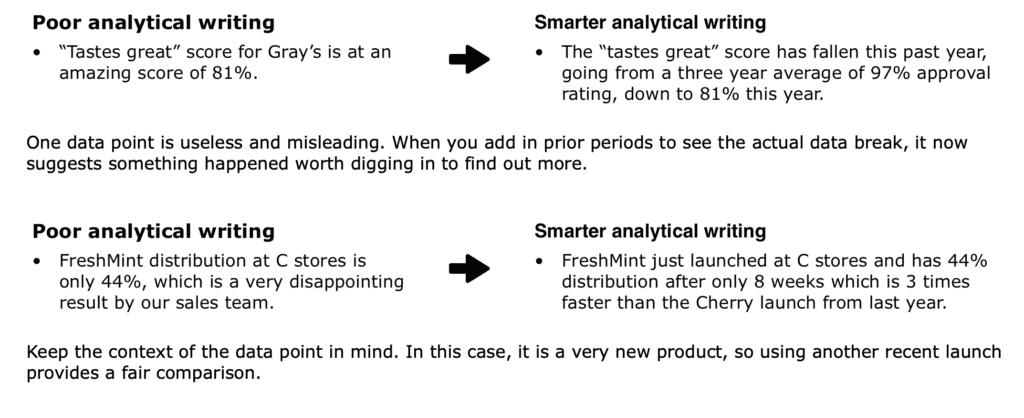

Comparisons always beat absolutes

Absolute numbers by themselves are useless. Always find comparisons. Only when given a relative nature to something important do you find the data break that tells a story. Is 50 degrees Fahrenheit warm or cold? If it’s Ottawa Canada and it’s December 24th, it is HOT and front-page news. If it is in Los Angeles on June 5th, it is COLD and front-page news.

Only when given a relative nature to something important do you find the data break that tells a story. You have to ground the data with a comparison, whether that’s versus prior periods, competitors, norms, or the category.

Every time you talk about data, try to speak in relative terms, comparing it to something that is grounded, whether that is last year, last month, compared to another brand, or versus the norm. Is it up, down or flat? Never give a number without a comparison, or your listener will not have a clue if it is a good number

Look for data breaks that bring the story to life

Comparative indexes and cross tabulations can bring out the data breaks and gaps that can tell a story. Use the “so what” technique to dig around and twist the data in unique ways until you find the point in which the data breaks and clear, meaningful differences start to show. Expose the trend and draw out the conclusion.

Match up facts to your conclusions, to solidify your opinions:

Summarize your analysis

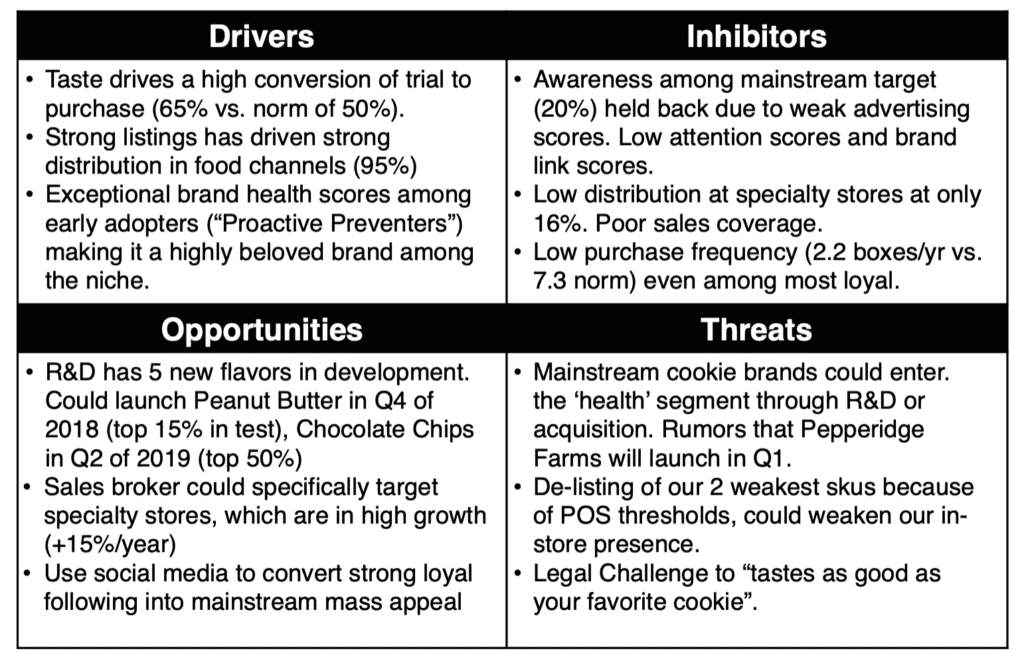

One tool looks at what’s currently driving and inhibiting growth, and what opportunities and threats you see in the future.

- First, what’s driving growth? The top factors of strength, positional power, or market inertia, which have a proven link to driving your brand’s growth. Your plan should continue to fuel these growth drivers.

- Second, what’s inhibiting growth? The most significant factors of weakness, unaddressed gaps, or market friction you can prove to be holding back your brand’s growth. Your plan should focus on reducing or reversing these inhibitors to growth.

- Then, look for the opportunities for growth: Look at specific untapped areas in the market, which could fuel your brand’s future growth, based on unfulfilled consumer needs, new technologies on the horizon, potential regulation changes, new distribution channels, or the removal of trade barriers. Your plan should take advantage of these opportunities in the future.

- Finally, look at the threats to future growth: Changing circumstances, including consumer needs, new technologies, competitive activity, distribution changes, or potential barriers, which create potential risks to your brand’s growth. Build your plan to minimize the impact of these risks.

Turn the analysis into a recommendation

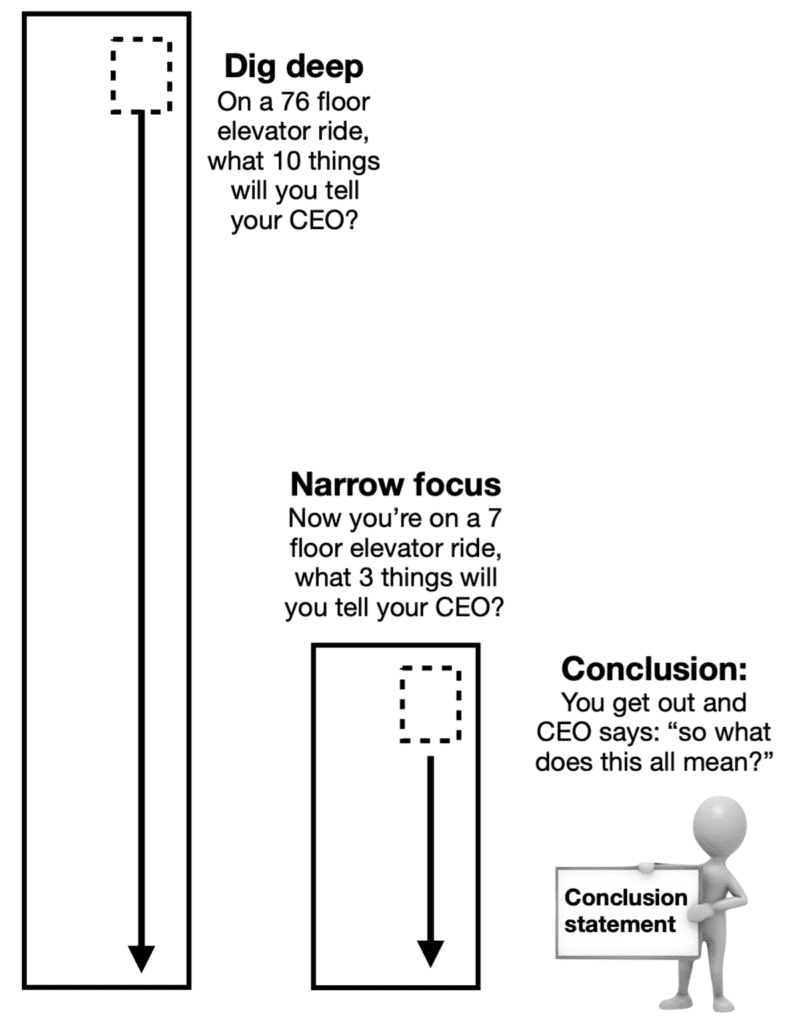

Organize your story into an elevator pitch

Organize your data to tell a story to your CEO that answers, “What’s going on with our brand?” I want you to dig in the opposite of how you tell the story.

To start with, assume you are on a 76-floor elevator ride with your CEO, and you have the chance to tell them ten things; what would you say?

Now narrow your focus, by assuming you are a seven-floor elevator ride; what three things will you tell your CEO?

Finally, you get out of the elevator, and the CEO says, “so what does this all mean?” You now have your conclusion statement.

Once you have your story, actually start with the conclusion first, followed by your three best analytical points.

- Keep an eye on the other seven other points for next year or if things change dramatically.

- Never tell your CEO anything obvious they already know. Don’t bore or frustrate your CEO.

- Try to surprise your CEO with a data secret you found out that you need to make sure the CEO knows.

- Find a significant change or data break, that has movement.

- Narrow to the points that matter to your story. You only get one ride with the CEO. Make the most of it.

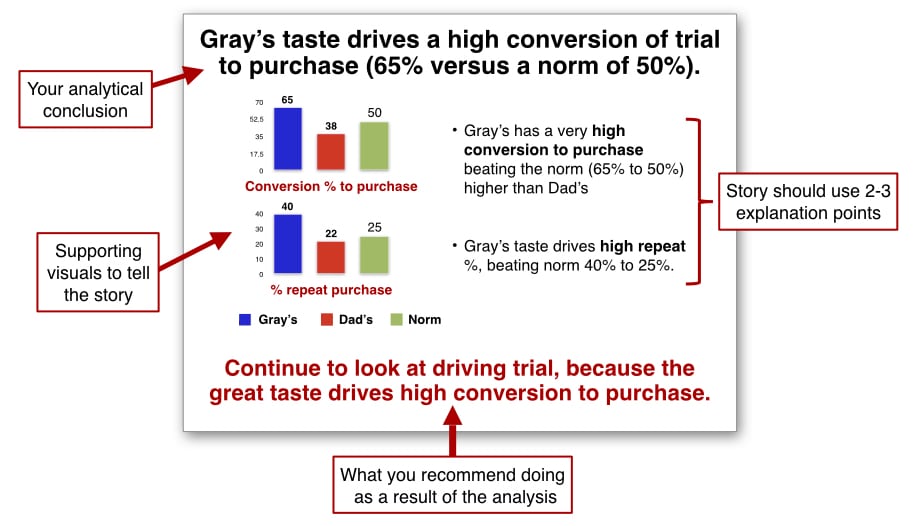

How to build the ideal analytical slide

When telling your analytical story through a presentation, start every slide with an analytical conclusion statement as your headline, then have 2-3 key analytical support points for your conclusion. Provide a supporting visual or graph to show the thinking underneath the analysis. Finally, you must include an impact recommendation on every slide. Never tell your management a data point without attaching your conclusion of what to do with that data.

Beloved Brands is the playbook to keep at your fingertips

Our readers tell us they reach for Beloved Brands a few times each week as a reference toolkit to help them with the day-to-day management of their brand.

- To start, we will challenge you with questions that get you to think differently about your brand strategy.

- Then, we take you through our process for defining your brand positioning. We will open your mind to new possibilities for how you see you can differentiate your brand. And, we use examples of brand positioning statements to bring the learning to life.

- Next, we will show you how to write a brand plan that everyone can follow. Make sure all stakeholders know precisely how they can contribute to your brand’s success.

- Moreover, we will show you how to run the creative execution process, show you how to write an inspiring brief, and make decisions to find both smart and breakthrough work.

- Finally, you will learn new methods to analyze the performance of your brand with a deep-dive business review.

Above all, over 90% of our Amazon reviews receive five-star ratings, and Beloved Brands has spent numerous weeks as a #1 bestseller in brand management.