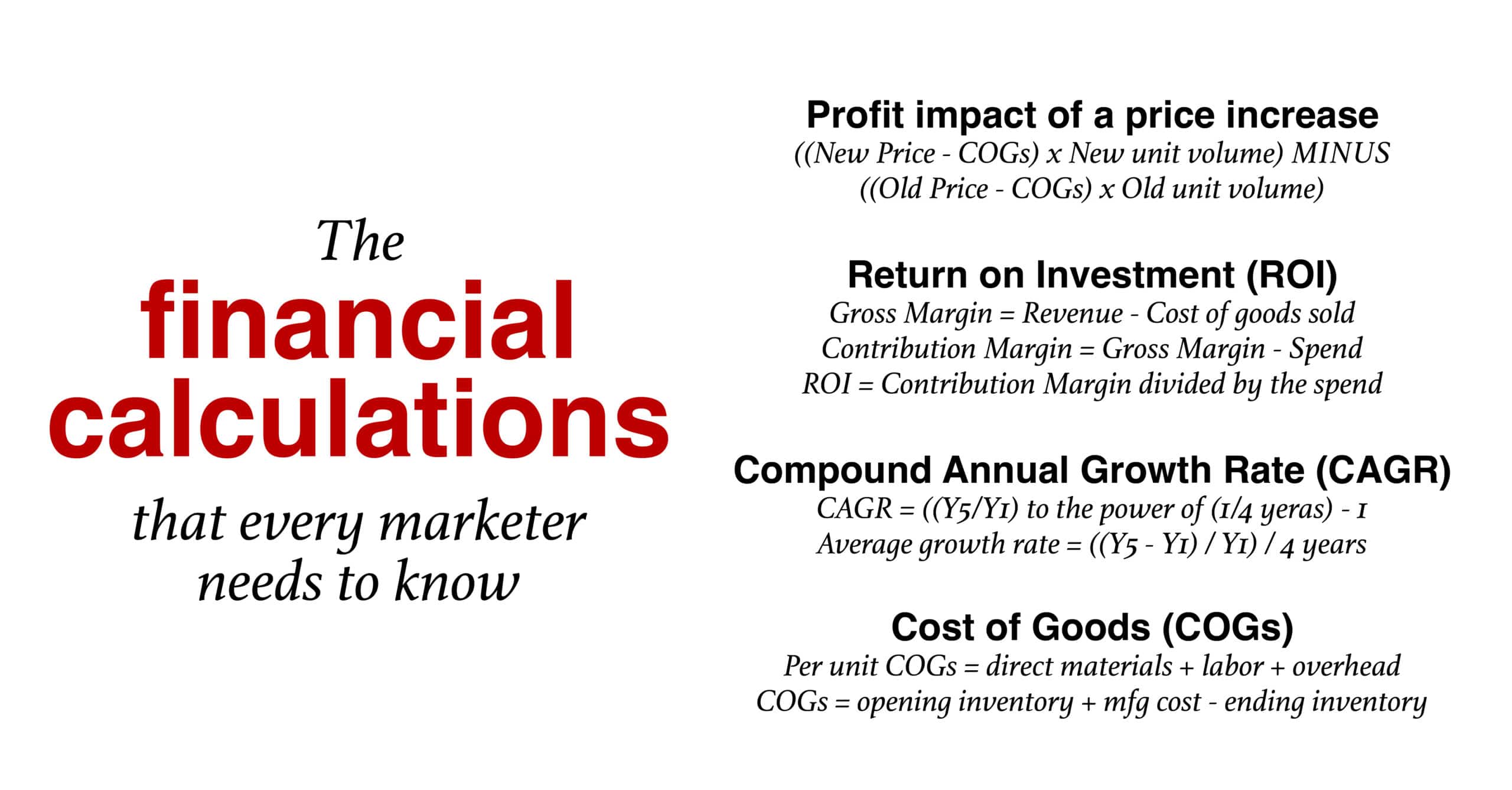

This article will lay out the financial calculations that marketers need to know. The first financial calculation includes how to calculate the profit impact from a price increase. Then, we lay out the financial calculation related to return on investment (ROI) related to any marketing activity.

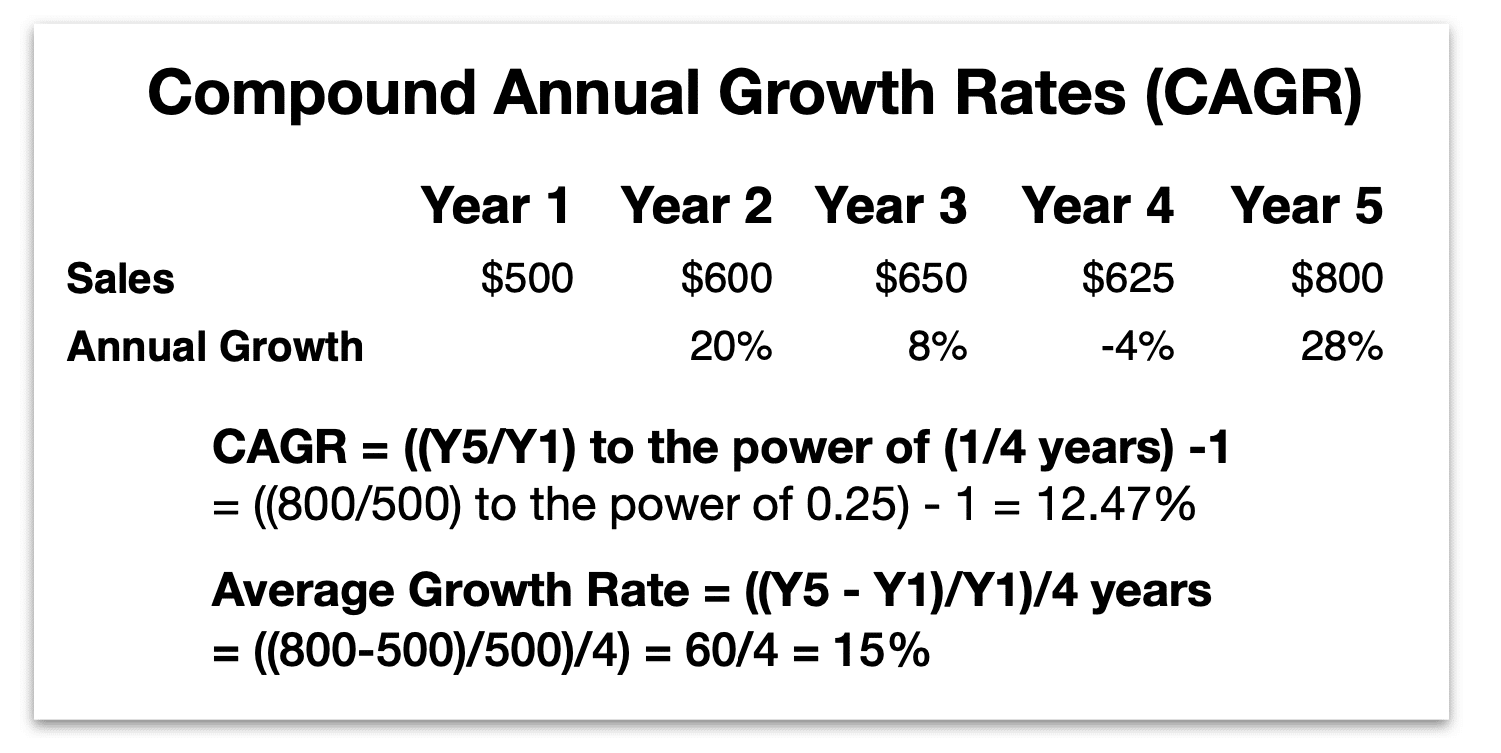

Next, many companies want to see growth rates. Annual growth rate is easy. However, compound growth rate gets more complex. We will show the financial calculation for how to calculate the compound annual growth rate, known as CAGR.

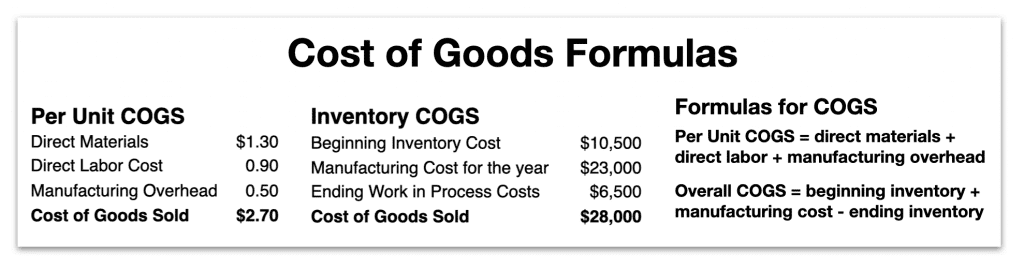

Finally, we will provide a couple of different financial calculations for Cost of Goods (COGs).

Marketing Finance

Financial calculation for a price increase

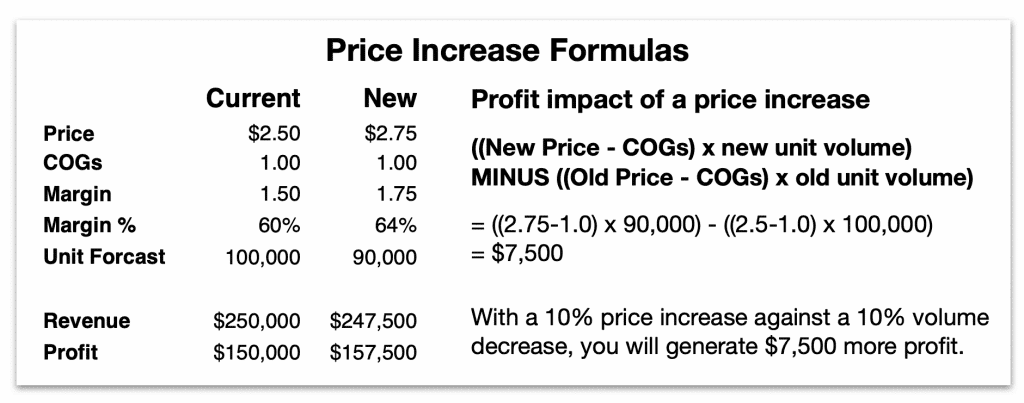

Financial calculations for a price increase will impact both revenue and profits. You should do an elasticity market research test to find out how your brand will perform.

Trading consumers up on price:

Make sure your brand can carve out a meaningful difference to create a second or third tier, so consumers can see an apparent reason to move up. Many brands will deploy a good/better/best approach to pricing. When your brand secures trust or a bond with the consumer, it will be easier to use your brand reputation and product performance to move loyal consumers up to the next level.

Trading consumers down:

When the brand sees a potential unserved market, it can trade consumers down when the move brings minimal damage to the brand image or reputation. In a tough economy, creating a lower-priced set of products can be a smarter strategy than lowering the overall price of your main brand. Once the economy bounces back, you can discontinue the lower-priced product option.

There are a few cautions around trying to trade consumers up or down. Be careful not to lose your focus on the brand’s core business or image. Stay focused because brands struggle when they try to be all things to everyone.

When trading down, try to take costs out of the product to ensure margins rates stay consistent. For a mass brand going through retail channels, it can be challenging to manage multiple price levels. The products with lower sales may receive poor shelf placement and miss out on retailer-merchandising tools.

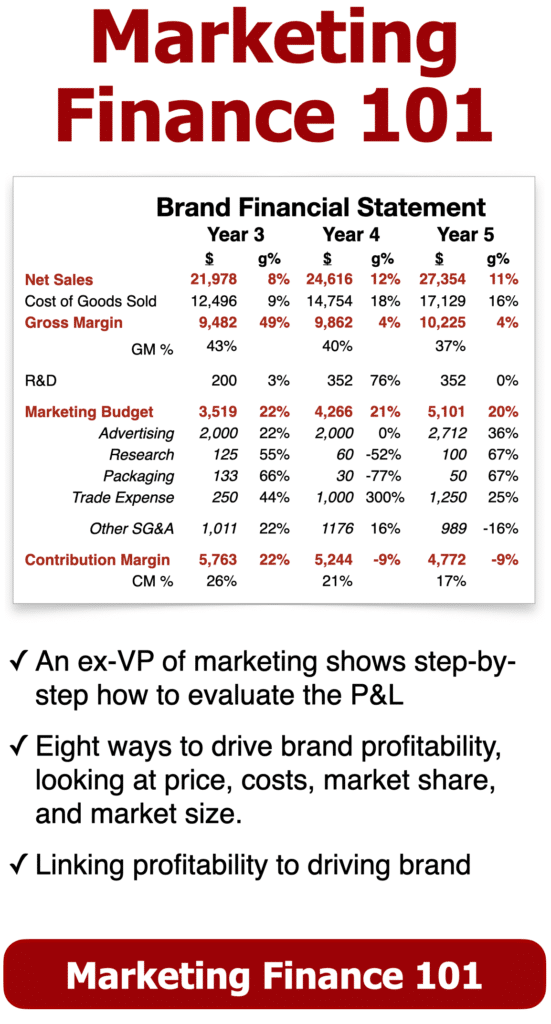

In this example, the price goes from $2.50 up to $2.75, only a 10% price increase. I assumed the cost of goods remained flat and I used a forecasted sales decline on units sold. The sales revenue falls slightly, but the profit goes up by $7,500 or by 4.6%.

ROI

Financial calculation for return on investment (ROI)

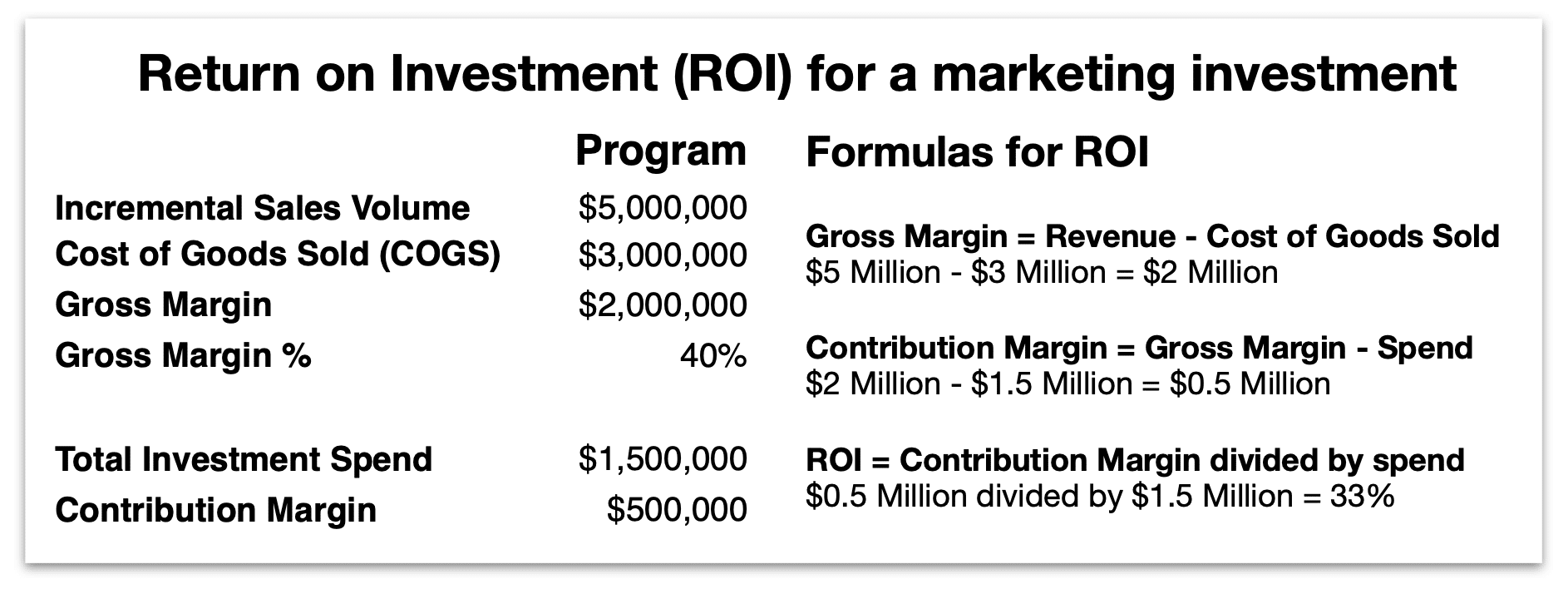

We should always bring an ROI mindset to your brand’s marketing budget. Balance the short-term and long term. In the example, the investment of $1.5 million generates an incremental sales of $5 million. After subtracting the cost of goods and the marketing investment, your brand makes $500,000 in additional profit. To calculate the ROI, take the profit and divide it by the investment. In this example, the ROI is 33%; if it holds, the investment will take three years to pay back.

Marketers are protective of marketing budgets. They usually want as much money as possible to carry out the activities on their priority list. The strategic brand leader should act as the owner/CEO by using budgets to manage the profit rather than act like a subject-matter expert trying to protect their turf.

Marketing cost decrease

Many times companies look at cost-cutting to counter short-term changes happening within other parts the P&L (price, volume or COGs). However, many of the best-run brands keep the investment strong, aligning with the longer-term strategy instead of a short-term situational need.

Marketing cost increase

Used when there is an opportunity to gain share against a competitor or as a defensive position trying to hold share. The brand should see an opportunity where significant revenue gains can cover off the lower profit ratios.

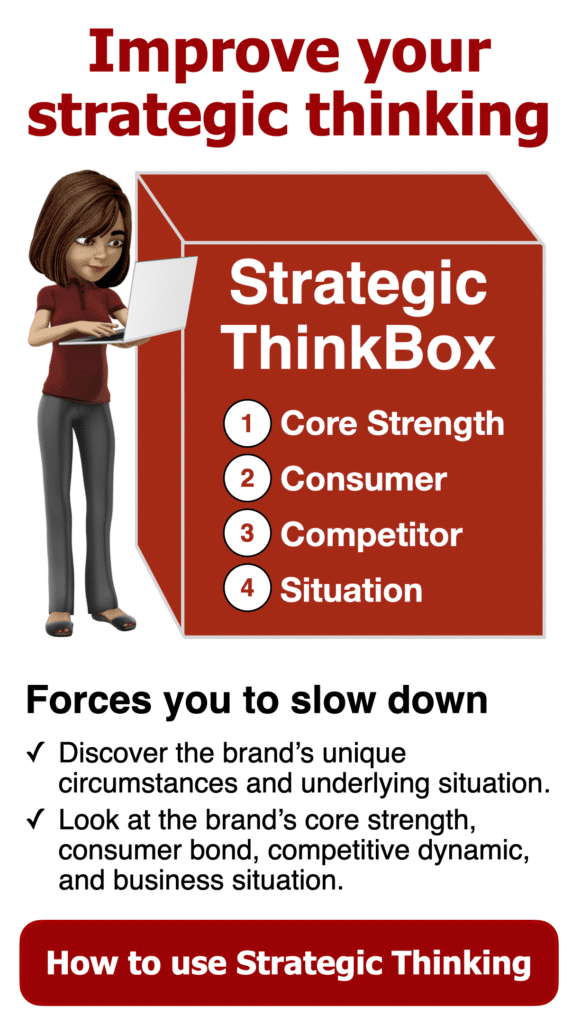

Use your strategic thinking to determine your marketing budget level.

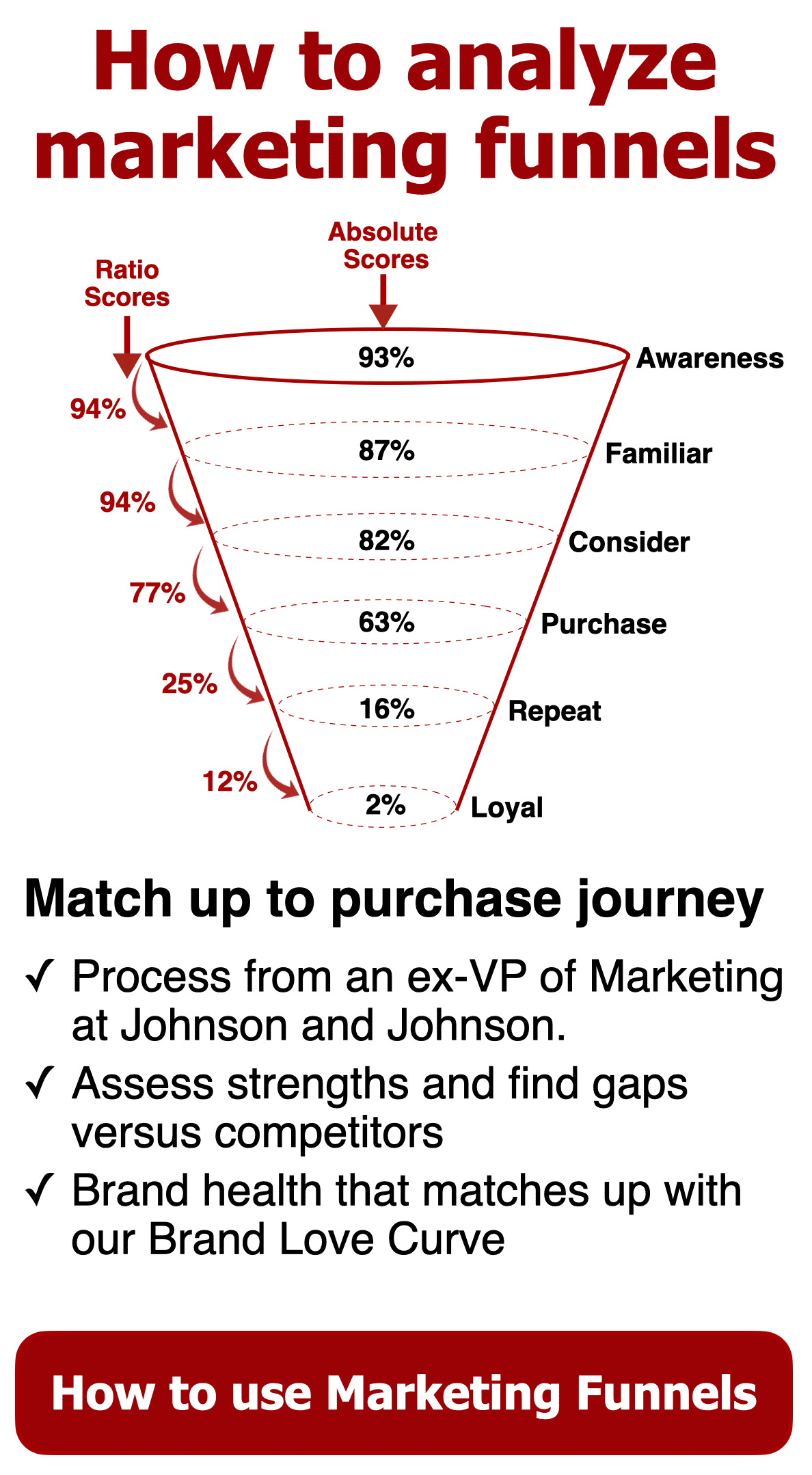

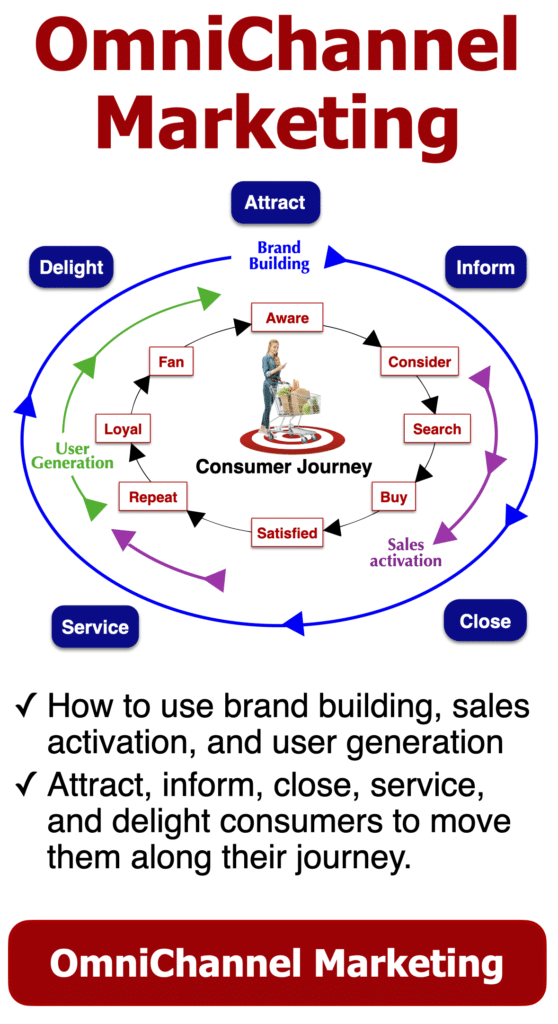

How connected your brand is with consumers determines where on the consumer journey you will focus. For an indifferent or liked brand, you should focus on driving awareness and purchase, which are usually high in cost. As you get to be more loved, you can concentrate on turning repeat purchases into routines. You can shift some of the marketing budgets over to create a superior consumer experience to reward your loyal users. The more loved a brand, the better the spend-to-sales ratios you should realize.

The degree of competitive warfare should impact the size of your budget.

Craft brands or disruptive brands are different enough to avoid competitive battles. When a brand takes on a challenger stance, the budget should go up. Be careful of competitive warfare situations, as a competitor may overreact, leading to spiralling spend escalations. Like a price war, marketing investment wars can also drain resources and will be viewed as a failure when there is very little market share change after the war.

Also, consider your brand’s core strength. If you use a product-led or brand story-led strength, you will have to invest in advertising to show how your brand is better or different. These brands will require significant investment. However, an experience-led brand should put the brand’s limited financial resources into creating a consumer experience. Early on, you will have to rely on a slower build through word-of-mouth advertising rather than paid media.

M A R K E T I N G B O O K

beloved brands

The playbook for how to create a brand your consumers will love

Beloved Brands is your secret weapon to guide you through every challenge that you face in managing your brand

Get ready to challenge your mind as we take you on a deep dive to find the most thought-provoking strategic thinking questions that will help you see your brand in a whole new light.

Our unique process for defining your brand positioning will push you to find fresh ideas and new possibilities for how to differentiate your brand based on both functional and emotional benefits.

But we won’t just leave you with ideas – we show how to transform your thinking into action.

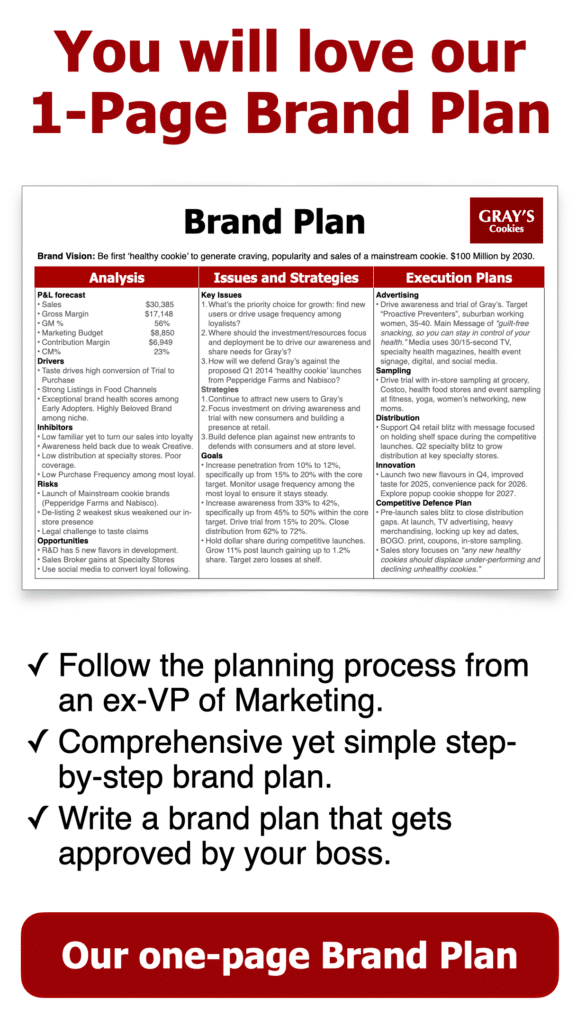

Learn how to write a brand plan that everyone can follow, ensuring that all stakeholders are aligned and contributing to your brand’s success.

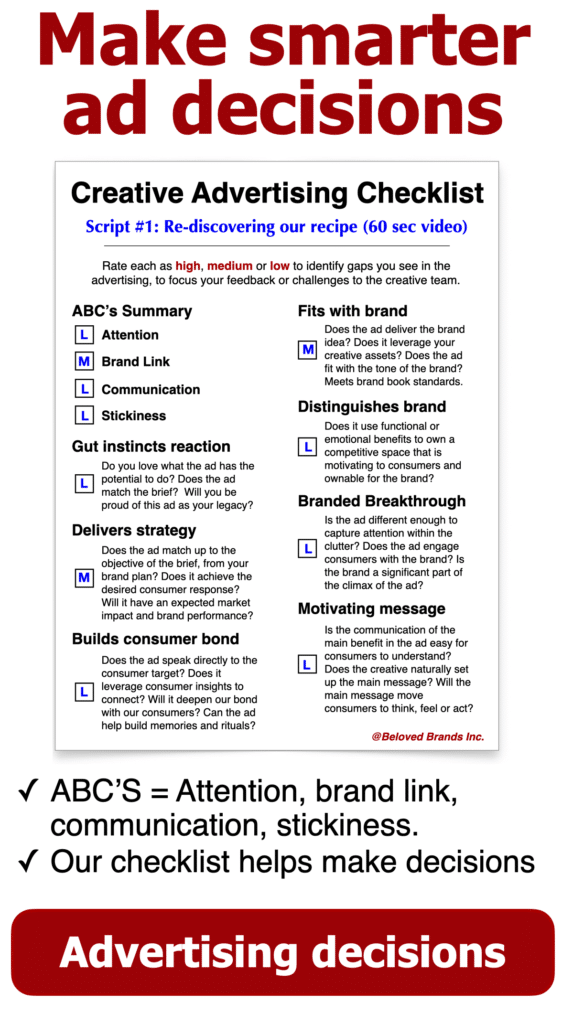

We’ll walk you through the marketing execution process, from writing an inspiring brief to making smart and breakthrough decisions on both creative advertising and innovation.

And when it comes to analyzing your brand’s performance, we’ve got you covered. Learn how to conduct a dive deep audit on your brand to uncover key issues that you never knew existed.

And, don't just take our word for it: our Amazon reviews speak for themselves.

With over 85% of our customers giving us a glowing five-star rating and an overall rating of 4.8 out of 5.0, we know we’re doing something right. And with numerous weeks as the #1 bestseller in brand management, you can trust that we have the experience and expertise to help you achieve success.

"The cheat code for brand managers!"

“It is without a doubt the most practical book for those who want to follow brand management that I have ever read in my life! Beloved Brands is written by a real, experienced marketeer for marketers. This book contains methodologies, tools, templates and thought processes that Graham actually used and uses in his career.”

Read our sample chapter on strategic thinking

CAGR

Financial Calculations for revenue growth

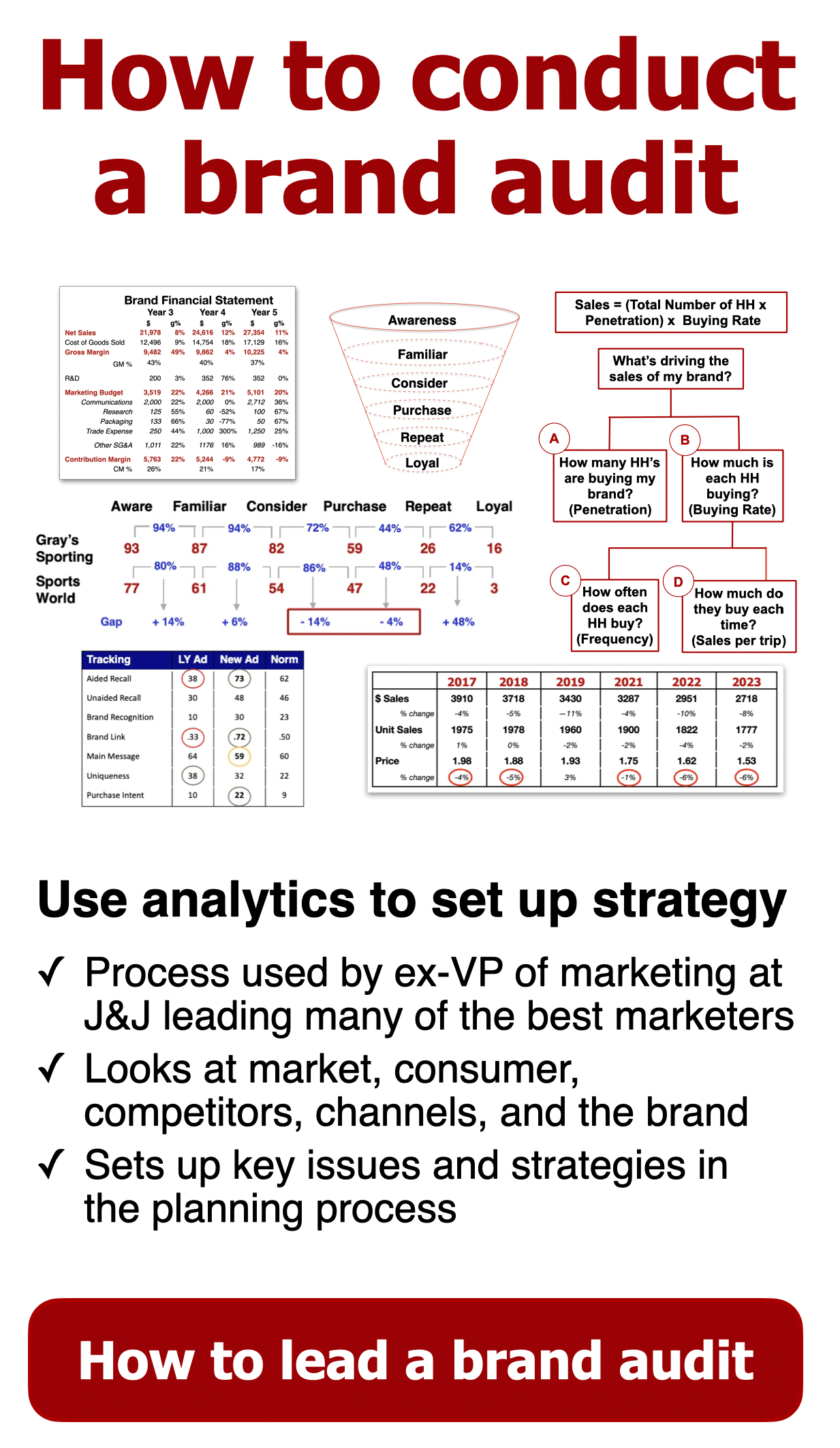

When calculating revenue growth, you can use average growth rate, yet a compound annual growth rate is a much truer version of what is happening. In the example above, the average growth rate is 15%, but the more accurate compound growth rate is 12.47%. If you are scared off by math, you can always use the CAGR calculator on the Investopedia website.

Cost of goods

Financial calculations for Cost of Goods (COGs)

Marketers usually assume that managing the cost of goods (COGs) is someone else’s job. However, I have included this financial calculation because product costs can be a useful strategic weapon that marketers should utilize.

Decreasing the cost of goods:

There are a few ways to drive down cost of goods (COGs). First, you can use your brand power and higher volumes to negotiate with suppliers. You can choose to use lower-priced raw materials, drive process efficiencies, or explore offshore manufacturing.

Increasing the cost of goods:

The most significant reason to increase cost of goods (COGs) is when upgrading to a premium market or an added benefit. Watch out for suppliers trying to pass along costs beyond inflationary rates.

When lowering your product costs, make sure the product change is not significantly noticeable. Where there is a noticeable product change, understand the potential impact on your brand’s perceived performance or quality. When costs go up, make sure the increases can be covered through other parts of your profit statement, whether through price increases, volume increases, or cuts to your brand’s marketing costs.

There are two financial calculations for how to calculate the cost of goods. The first uses the unit costs, which includes the variable material and labor costs, plus the manufacturing overhead. Alternatively, you can use an inventory cost method, which takes the beginning inventory cost plus the cost for the year, then subtract the ending inventory cost.

10 financial questions to assess your brand’s worth:

- Start by asking what is your brand’s compound annual growth rate (CAGR)? Use the financial calculations to explain the ups and downs over the past five years.

- What are your gross margins and contribution margins over the last five years? Can you break it out by product line? Is there more pressure from price or the cost of goods?

- What is your brand’s marketing budget breakout? Variable direct costs versus indirect fixed dollars? What is the break between media and creative production? Consumer spend versus trade spend?

- Have you completed any pricing elasticity studies? What did you learn about your brand? If you did increase your price, what did you see in the marketplace?

- How is your brand’s overall strategy impacting your brand’s profits? And, how do your decisions on your brand’s core strength, consumer connection, competitive pressures, and situation impact your financials?

- How are your current brand/business performance metrics, brand’s market goals, and financials linked?

- Over the past five years, what are the programs that drive the highest and lowest ROI? Use our financial calculations for ROI.

- How does your business model impact your overall profit? And, what are you focusing on right now?

- What are your forecasting error rates? Is there a seasonality impact? Moreover, how do economic factors impact your brand’s financials? How reasonable are your inventory levels?

- What financial pressures do you face on an annual or quarterly basis?

Marketing Finance 101

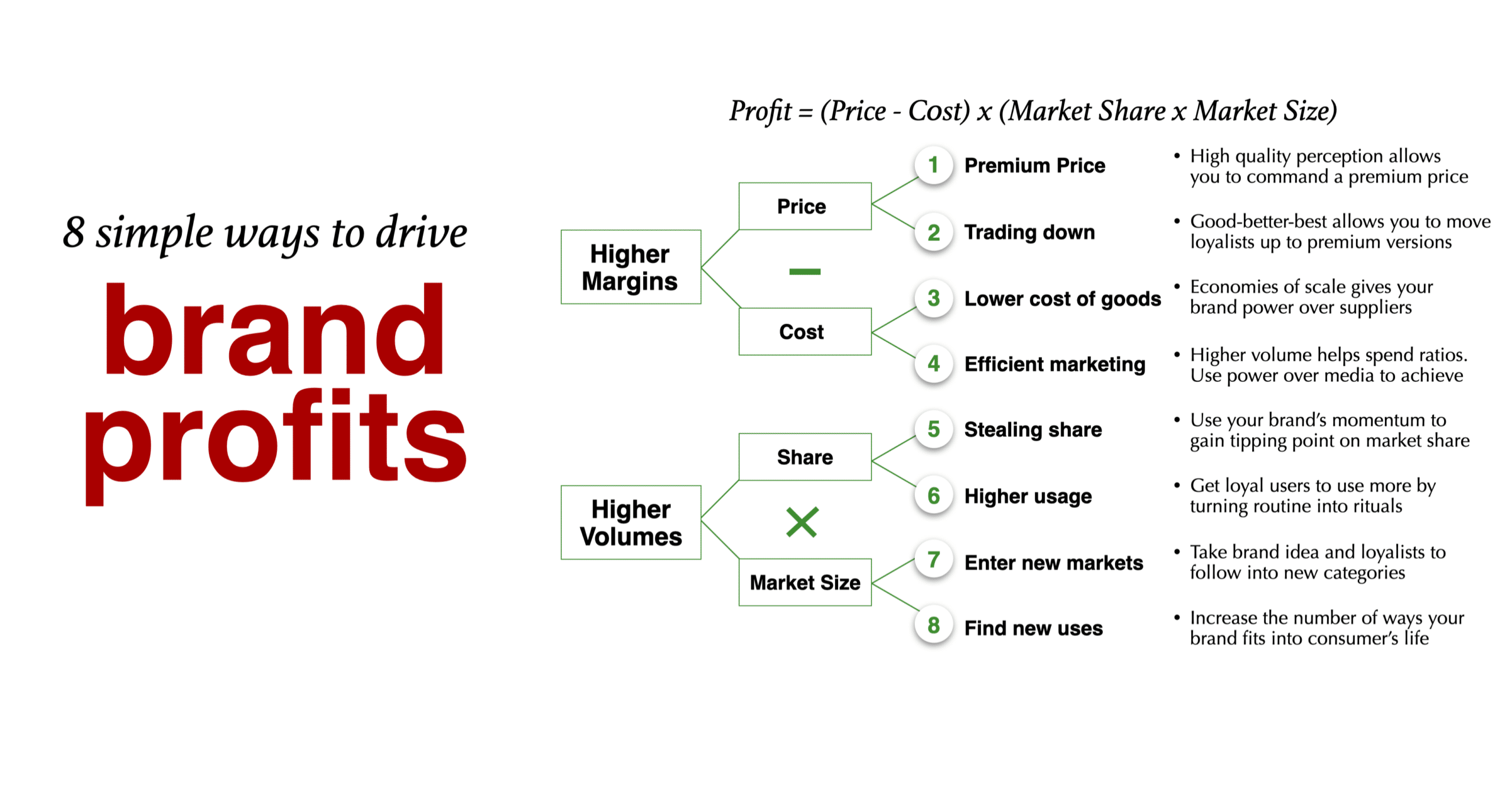

The 8 ways brand leaders can drive profit

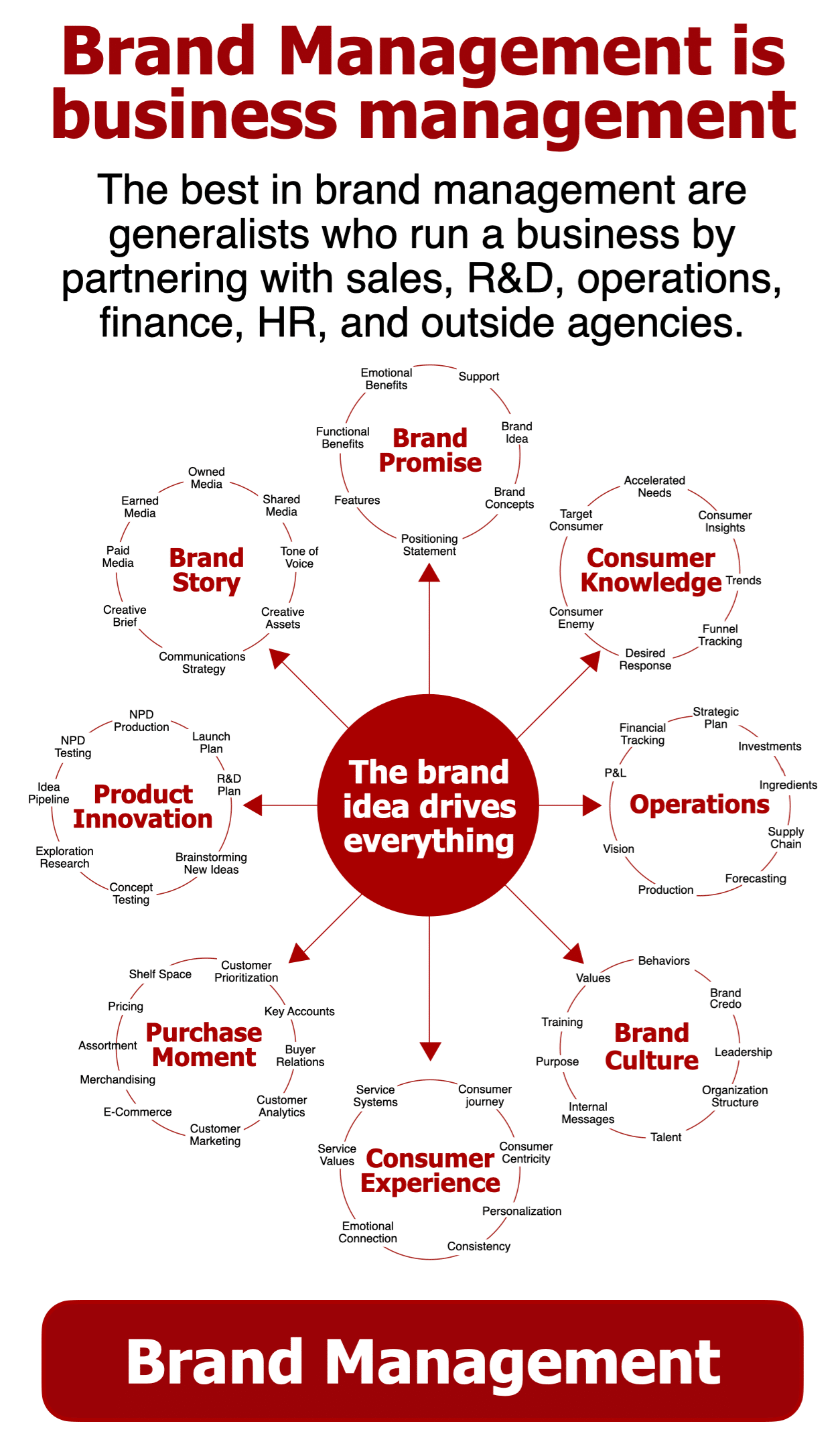

While good marketers can run brands and marketing programs. Great marketers can drive their brands P&L and deliver growth and profit for their brands. These financial calculations will help you be to manage the eight ways the Brand Leader can drive profits:

- Pricing

- Trading the consumer up or down

- Product Costs

- Marketing Costs

- Stealing other users

- Getting current users to use more

- Enter new categories

- Create new Uses for your brand

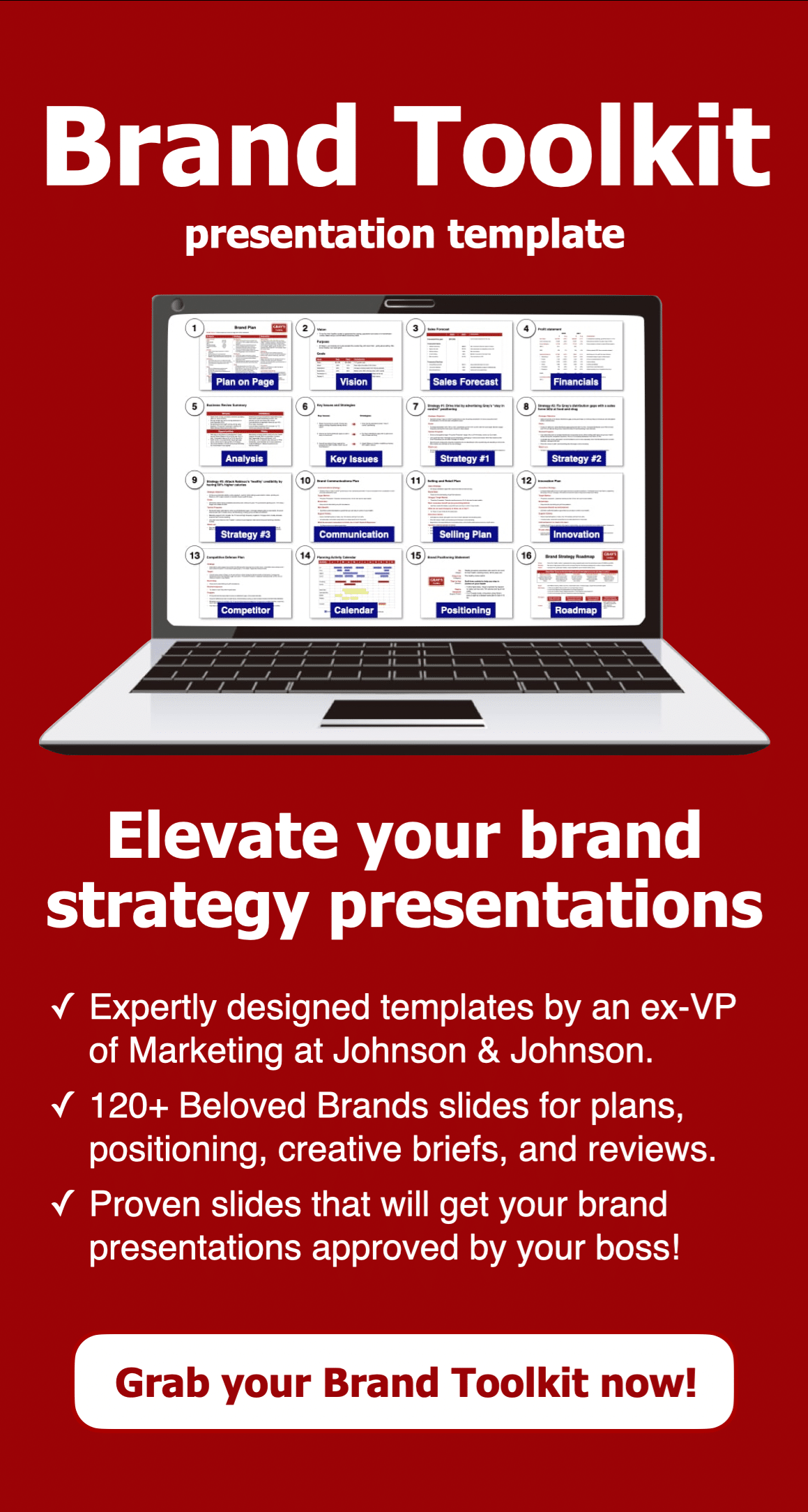

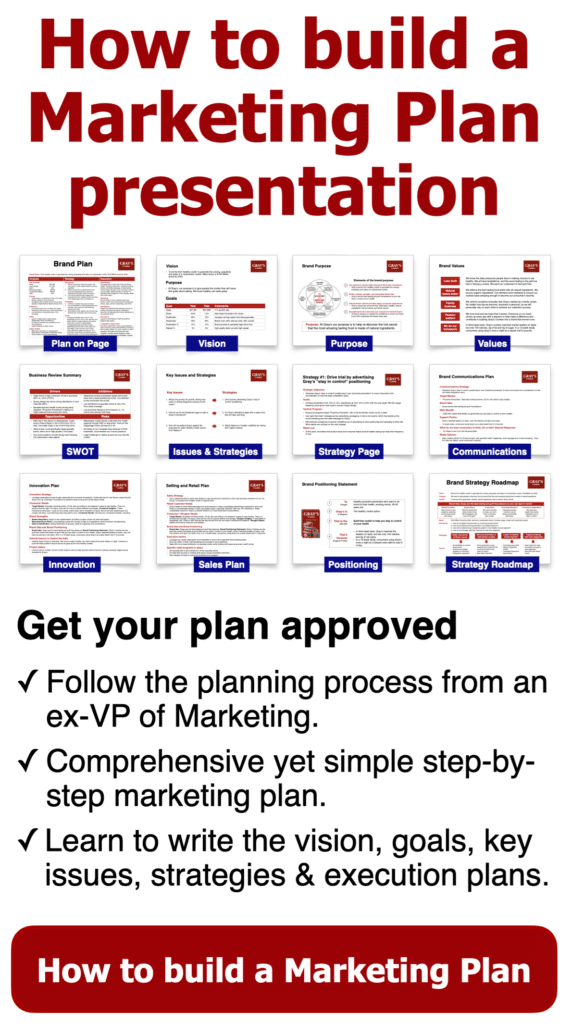

Discover a comprehensive approach to brand growth with our diverse collection of templates:

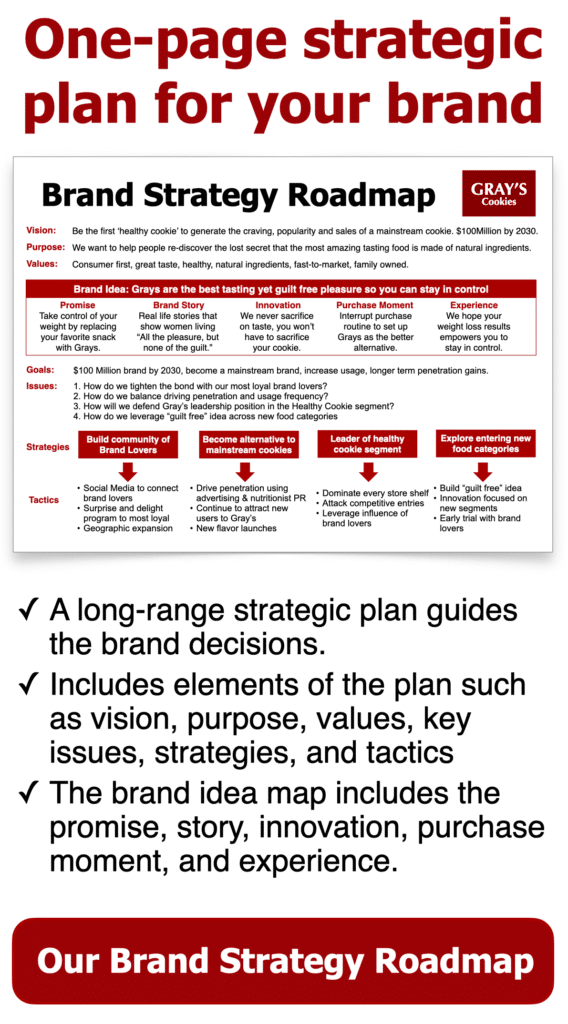

- Brand Plan Template: Featuring slides for outlining your vision, purpose, analysis, key issues, strategies, and execution plans. Additional slides include sales forecasts, financials, and activity calendars to ensure a well-rounded plan.

- Brand Positioning Template: Equipped with slides to help you define your target profile, create a brand positioning statement, and develop a brand idea, concept, values, story, credo, and creative brief for a strong brand identity.

- Business Review Template: Complete with slides for conducting in-depth analysis of the marketplace, customers, competitors, channels, and your brand, empowering you with insights for informed decision-making and strategic planning.

Choose the right brand toolkit for your business needs

Brand Toolkit for brand consultants

Our Brand Consulting Toolkit provides all the necessary templates, allowing you to streamline your process and concentrate on your clients! We have combined our brand toolkits in one package.

Brand Management Mini MBA

Invest in your future. If you are an ambitious marketer, looking to solidify your marketing skills, our Brand Management Mini MBA will teach you about strategic thinking, brand positioning, brand plans, advertising decisions, and marketing analytics.

Have a look at our brochure on our Mini MBA program

Use > to move through the brochure or x to see the full screen.

You get 36 training videos, key chapters from our Beloved Brands Playbook, and a Brand Management Workbook with exercises to try in real-time. Earn a certificate you can use on your resume or LinkedIn profile.

M A R K E T I N G B O O K

b2b brands

the b2b playbook for how to create a brand your customers will love

As a B2B marketer, you know that the key to driving growth is a strong brand. But how do you develop and execute a winning B2B brand strategy? Look no further than the B2B Brands playbook.

Prepare to think differently about your B2B brand strategy with B2B Brands. We want to challenge you with thought-provoking questions and take you through our process for defining your brand positioning. Our goal is to expand your mind to new possibilities for your brand by using real-life examples of successful B2B brand positioning strategies.

We’ll start by showing you how to create a brand plan that’s easy for everyone to follow, ensuring that all stakeholders understand how they can contribute to your brand’s success. Moreover, we guide you through the creative execution process, including how to write an inspiring brief and make decisions to achieve smart and innovative communications.

Finally, we’ll teach you new methods to analyze your brand’s performance through a deep-dive business review.

Our B2B Brands playbook offers a wealth of knowledge and insights, including B2B case studies and examples to help you learn new techniques. It’s no wonder that 85% of our Amazon reviewers have given us a 5-star rating. So, join us on this journey to unleash the potential of your B2B brand.