What should you do when someone hands you a financial statement. If you want to succeed in brand management, you have to understand marketing finance. After all, you are running a business. Consequently, if you only like the activity of marketing, then you should become a subject matter expert. Because, if you cannot work the finances of your brand, you will not get promoted beyond brand manager.

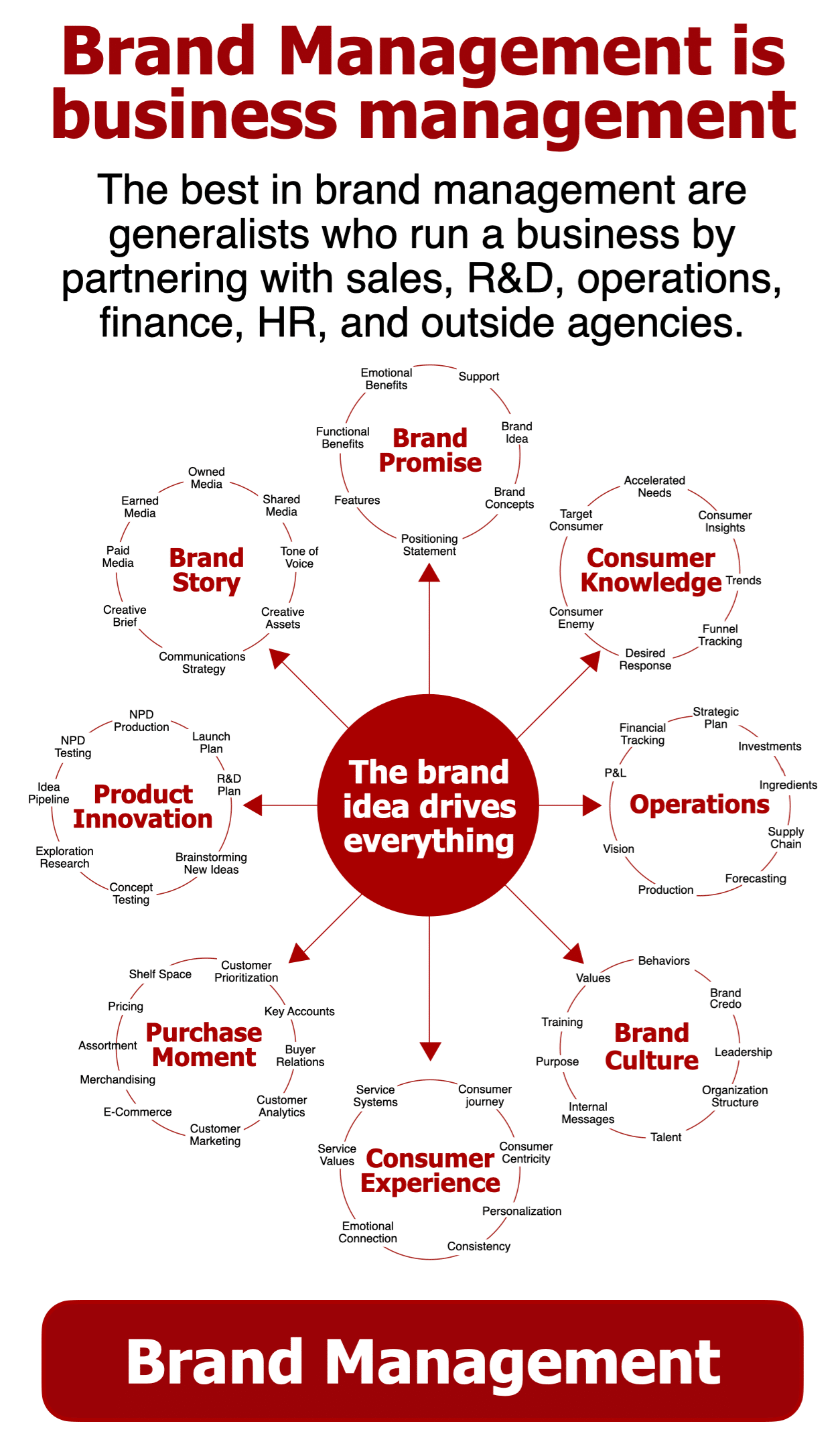

Anyone who does not include “profit” in their definition of a brand has never run a brand before. To me, a product is a basic commodity you sell. Most importantly, a brand creates a bond that leads to a power and profit beyond what the product alone can achieve.

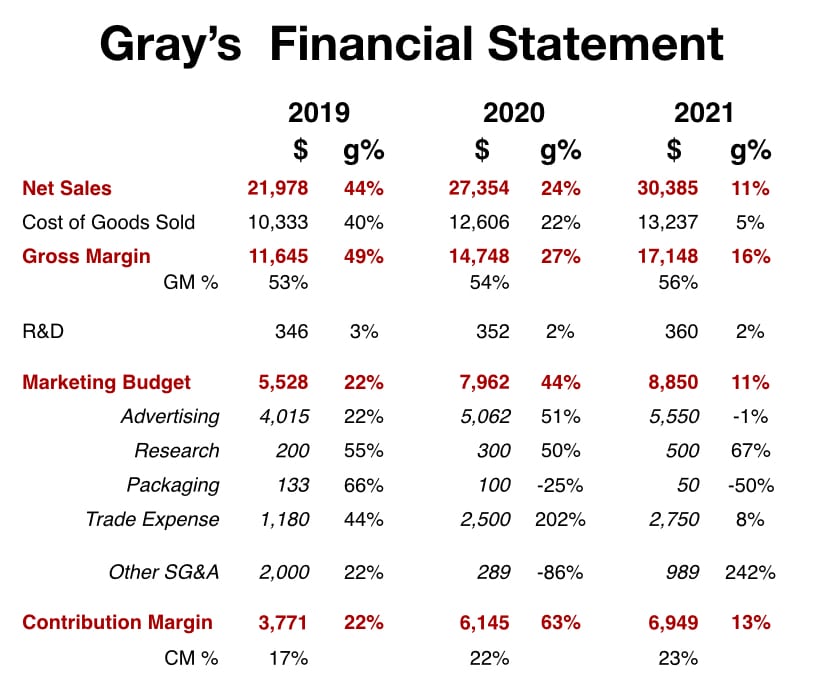

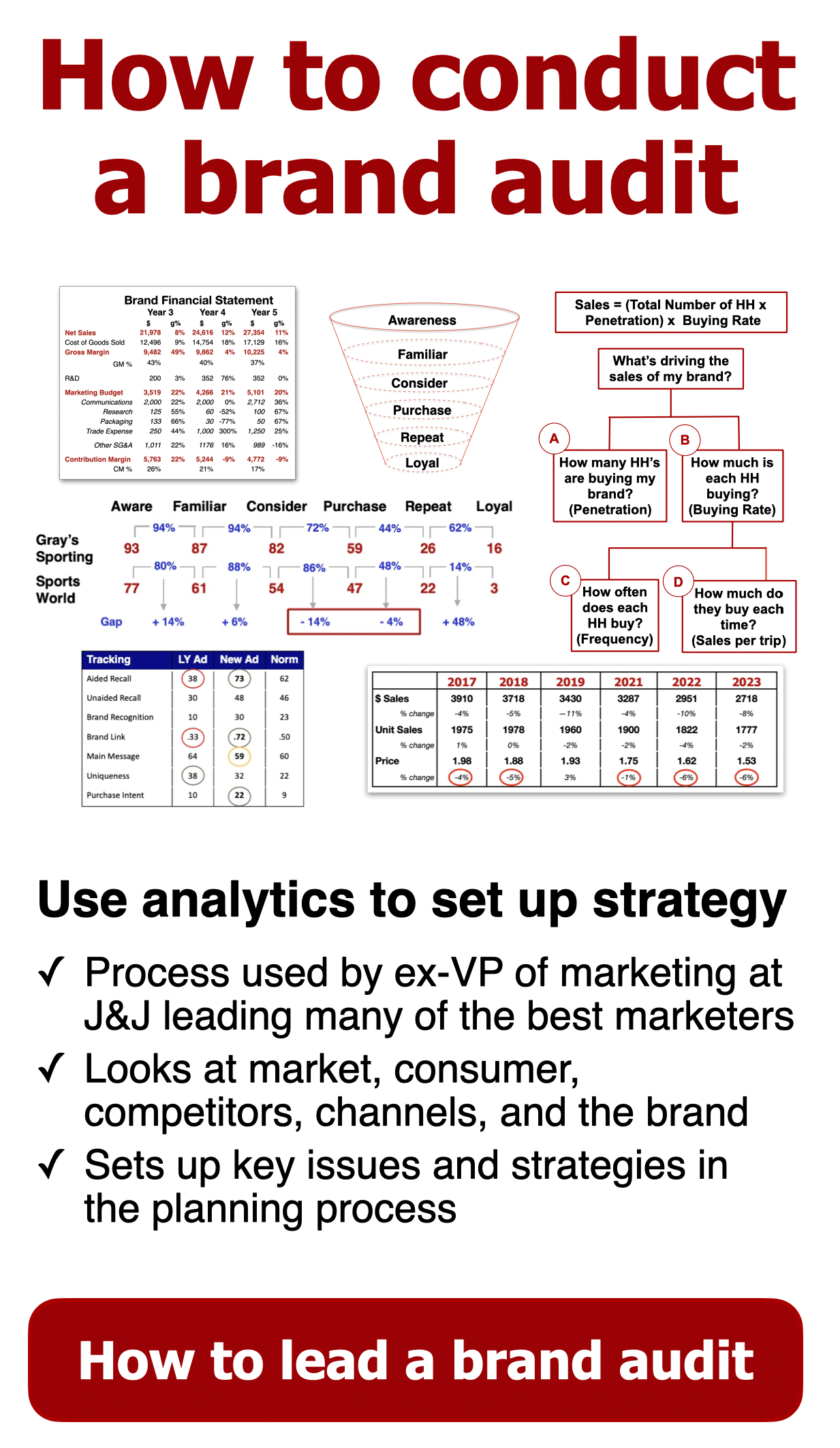

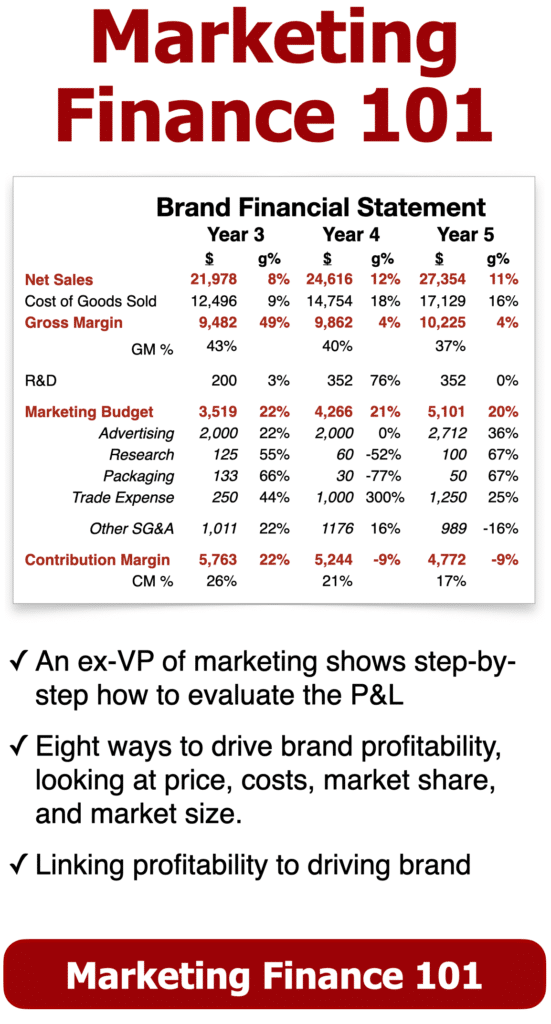

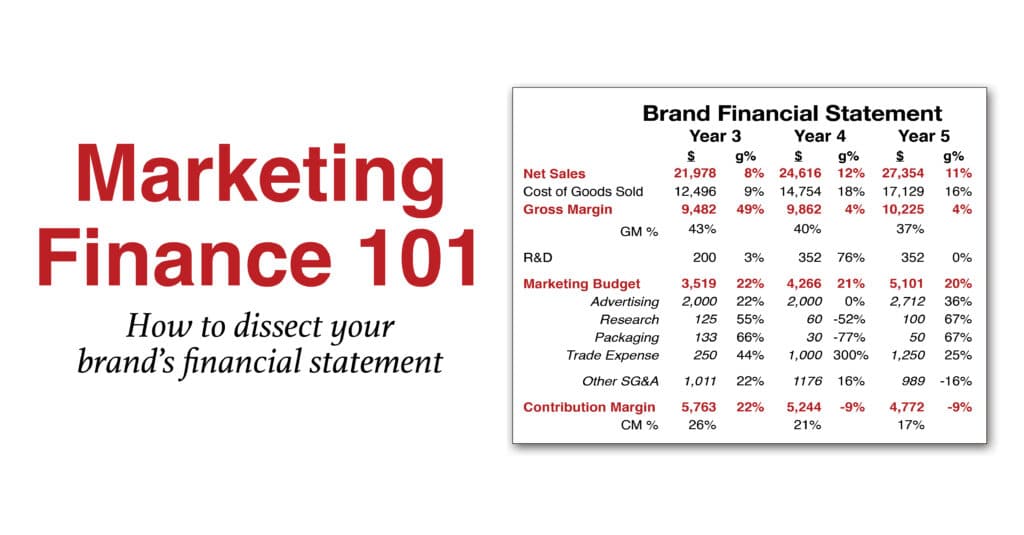

To start, we use our marketing finance 101 to do a quick dissection of your profit statements.

Marketing Finance

For many of us, we became marketers because we were attracted to the strategic, creative, and psychology aspects of business. And, if finance is not a natural skill, when your finance manager hands you the brand’s profit and loss (P&L) statement, it can be rather intimidating. To start, look at the sales growth, gross margins and draw out comparisons.

First, you need to understand the sales growth rate, relative to the economy or the category growth. Then, look at the gross margin percentage. Next, dig into the contribution margin percentage. Finally, do a quick comparison between spending growth rate and the sales growth rate.

Once you have understand these four elements of the financial statement, you can begin digging deeper.

Financial assessment

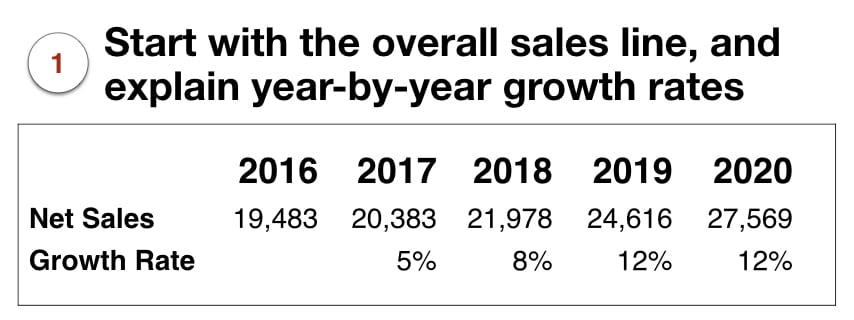

Step 1: As a leader of the brand, I start by trying to understand the growth rate.

Most brand leaders have brand growth as their number one objective. Marketing finance starts with a quick calculation to figure out the average growth rate but, as you dig in, you should try to find out what happened each year to give you a better feel of the brand performance. There are two calculations you can use, either average growth rate or compound annual growth rate (CAGR).

In this example, the average growth rate is 7% and CAGR % is 9.1%, but very high compared to the overall economic growth of 2-3%. My first instinct would be to look at the category growth to see if the brand is gaining or losing market share. Next, the year-by-year growth shows the growth rate has shot up to 12% over the past two years. Then, I would make a mental note to expect to see this as an investment brand and determine whether the profit is paying off yet.

Video on how to build your sales forecast

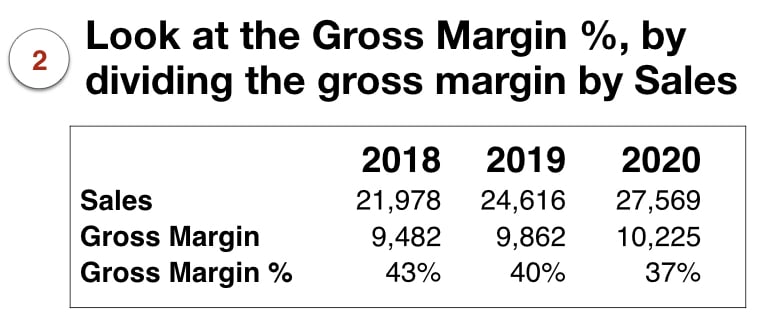

Step 2: My eye is drawn immediately to the gross margin percentage, as a first signal of brand health or to try to understand the strategy behind the brand.

Divide the absolute gross margin by the sales. You can assess the brand’s health by comparing the margin percent over time to see the trend line, with other brands in your portfolio to assess the opportunity cost, or with other competitive brands in the category.

In this example, the gross margin percentage has fallen from 43% in 2018 down to 37% in 2020, which should prompt you to go a layer deeper to look at price and cost of goods. Regarding price, dig around to see if there has been an average price decrease, then look to see if it is due to an increase in trade spend, a shift in the sales mix to lower-priced items, or even a shift to lower margin items.

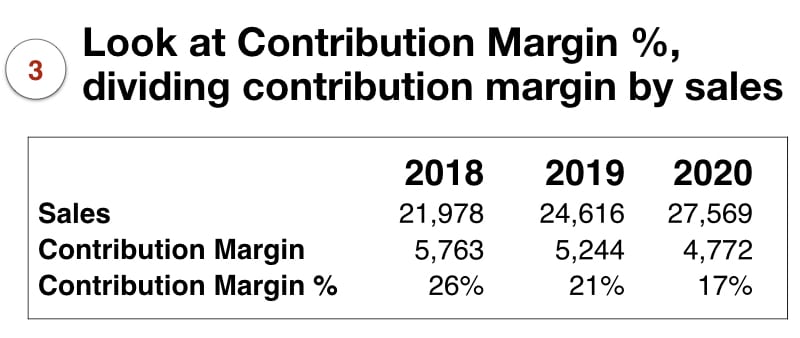

Step 3: Next, look at contribution margin percentage, dividing the bottom line contribution income by the overall sales, using your brand’s cost of goods and impact on overall profit.

Some cost factors are outside the brand’s control, such as foreign exchange, raw material cost increases, duties, and transportation costs. However, you also need to look out for factors within the brand’s control. And, was there a strategic decision to change to a higher cost raw material? Was there increased quality control at the manufacturing site? Did you switch to a more expensive supplier or change the location of your production?

In the example, an alarm bell goes off when I see the contribution margin percentage has fallen from 26% to 17% in three years. My first observation is the sales are up dramatically, yet both the gross margin percentages and contribution margin percentages are down. While the gross margin percentage is down, the gross margin dollars increased. However, in this case, the contribution margin dollars have gone down from $5,763 to $4,772. After two years of investment, the brand is not responding fast enough to cover that spend level.

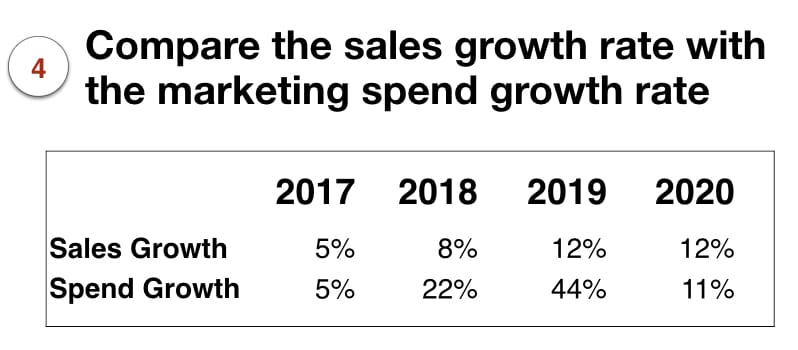

Step 4: Finally, look at the comparison between the sales growth rate and the spending growth rate.

While sales are growing at 12% over the past two years, spending is up 22%. The brand is not covering the spending increase. Dig in to understand if the payback was expected to be slower. If not, I would dig in to explain why it is not paying back: not the right message, competitive activity, or market dynamics.

Brand profit

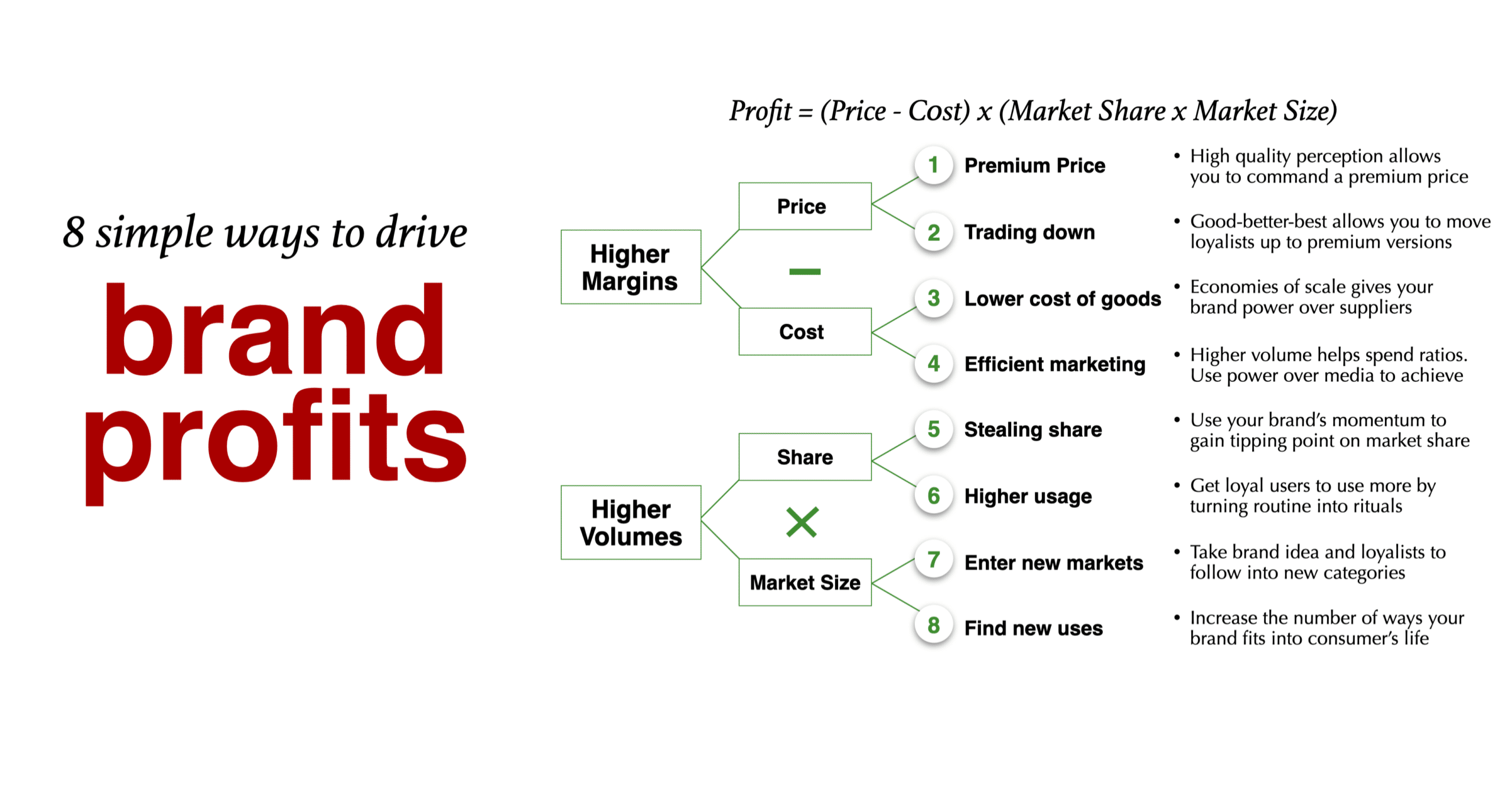

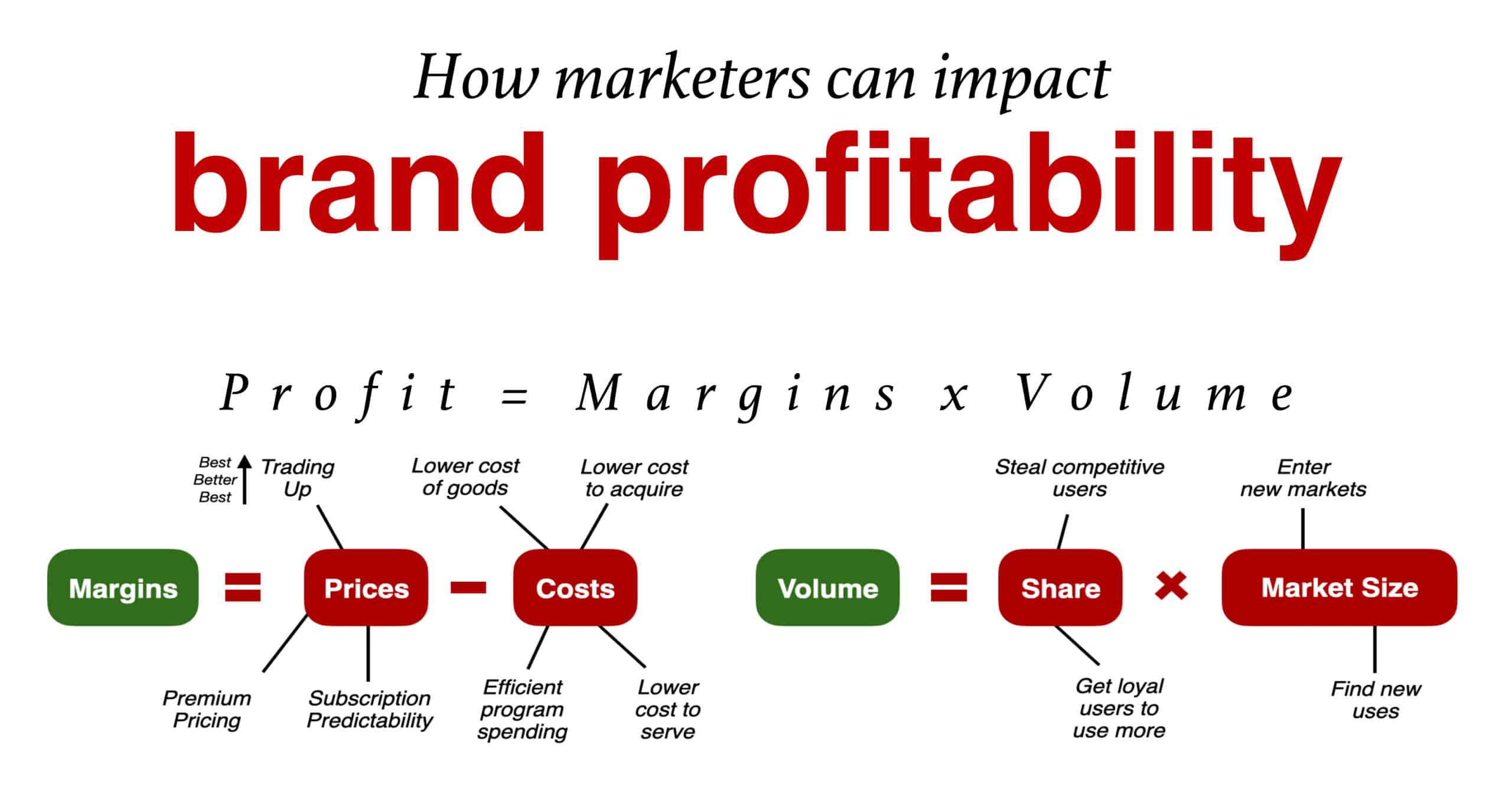

The 8 ways to drive profit:

While good marketers can run brands and marketing programs, great marketers will drive brand profitability. As part of marketing finance, here are eight ways the Brand Leader can drive brand profits:

- Premium pricing

- Trading the consumer up or down

- Product Costs

- Efficient Marketing Costs

- Stealing other users

- Getting current users to use more

- Enter new categories

- Create new Uses for your brand

Premium pricing

While many marketers think of price as a defensive reaction, most times to counter inflation or something happening in the trade channels, marketers should refocus and start using price as a weapon to drive Brand Value. Beloved brands seem more capable at driving profits through pricing, but they also are careful to ensure the premium does not become excessive to create backlash.

Price Increase.

You can do a price increase if the market or brand allows you. It likely has to be based on passing along cost increases. Factors that help are whether you are a healthy brand or it’s a healthy market, as well as the power of your brand vs. competition and channel.

Price Decrease.

Used when fighting off competitors if you need to react to a sluggish economy or channel pressure. Another reason to decrease price is if you have a competitive advantage around cost, whether that’s manufacturing, materials, or distribution.

There are watchouts for price changes. It’s difficult to execute, especially if it has to go through retailers. You need to understand power relationships–how powerful are the retailers? Moreover, retailers often scrutinize price changes so badly that you must have proof of why you are doing it. It’s likely your Competitors will over-react. So, your assumptions you used to go with the price increase will change right after. And finally, it’s not easy to change back.

Trading consumers up

Aside from price increases, another strategy to drive profit is to create a range of products that allows you to reach up or down to a new set of consumers. You need to ensure that you are doing this for the right reason or it could backfire on you.

Trading Up.

If you have a range of products, sometimes it can be beneficial to get consumers to trade up. Can you carve out a meaningful difference to create a second tier that goes beyond your current brand? Do your brand image/ratings allow it?

Trading Down.

Risky, but you see un-served market, with minimal damage to image/reputation of the brand. In a tough economy, it might be better to create a value set of products rather than lower the price on your main products.

There are a few watch outs around trying to trade up or down: Premium skus can feel orphaned at retail world—on the shelf or missing ads or displays. Managing multiple price levels can be difficult—what to support, price differences etc. For all the effort you go to, make sure your margins stay consistently strong through the trading up or down. Be careful that you don’t lose focus on your core business. You can’t be all things to everyone. The final concern is what it does your Brand’s image, especially risky when trading downward.

Product Costs

Managing product costs can be a weapon to enhance the brand’s value. It can be either your cost of goods or the marketing costs. As marketers, we sometimes think the cost is someone else’s job. But it’s an effective weapon that marketers should be utilizing.

Cost of Goods Decreases.

You can use the power of your brand to drive power over your suppliers; you find cheaper potential raw materials, process improvement, or find off-shore manufacturing.

Cost of Goods Increases.

Make sure that you manage the COGs as they increase. Watch out for suppliers trying to pass along costs. But realize that with new technology, investing in the brand’s improved image, going after premium markets, offering new benefits, or a format change, the cost of good increases could be a reality.

The watch outs with managing costs: with cuts, make sure the product change is not significantly noticeable. You should understand any potential impact in the eyes of your consumers on your brand’s performance and image. Importantly, explore whether the P&L covers these costs, either increased sales or efficiency elsewhere. Managing your margin % is crucial to the long-term success of your brand. It’s all about managing the overall brand profit.

Marketing Costs

Marketers are protective of marketing budgets. They usually want as much money as possible to carry out the activities on their priority list. The strategic brand leader should act as the owner/CEO by using budgets to manage the brand profit rather than act like a subject-matter expert trying to protect their turf.

Marketing cost decrease:

Companies often look at cost-cutting to counter short-term changes within other parts of the P&L (price, volume, or COGs). However, many best-run brands keep the investment strong, aligning with the longer-term strategy instead of a short-term situational need.

Marketing cost increase:

Used when there is an opportunity to gain share against a competitor or as a defensive position trying to hold share. The brand should see an opportunity where significant revenue gains can cover the lower profit ratios.

Use your strategic thinking to determine your marketing budget level. How connected your brand is with consumers determines where on the consumer journey you will focus. For an indifferent or liked brand, you should focus on driving awareness and purchase, which are usually expensive. As you get to be more loved, you can concentrate on turning repeat purchases into routines. You can shift some of the marketing budgets to create a superior consumer experience to reward your loyal users. The more loved a brand, the better the spend-to-sales ratios you should realize. This is your chance to manage the brand profit.

Beloved Brands Marketing Training

To view, use the arrows to see our Beloved Brands Marketing Training program brochure.

It's time to elevate your marketing team's performance with our Beloved Brands Marketing Training program.

Our marketing training makes your marketers smarter with brand analytics, strategic thinking, brand positioning, brand plans, and marketing execution.

Steal other users

Externally, the share and volume game are traditional tools for brands who want to increase brand profit. Either stealing other users or getting current users to use more.

Offensive Share Gains.

Use it when you have a significant Competitive Advantage or see untapped market needs. Or opportunistic, use first mover advantage on new technology.

Defensive Share Stance.

Hold the fort until you can catch up on technology, maintain profitability, loyal base of followers needs protecting.

Be careful when trying to gain share. A beloved brand has a drawing power where it gains share without using attack modes. Attacking competitors can be difficult. It could just become a spend escalation with both brands just going at it. After a share war that’s not based on substantive reasoning (e.g. technology change), there might be no winners, just losers. The channel often tries to play one competitor against another for their own gain. Watch out for what consumers you target in a competitive battle: some may just come in because of the lower price and return to their usual brand.

Get users to use more

Share of Requirements.

Going after frequency is a different strategy to increase brand profit. In many categories, even loyal consumers will work within a competitive set of favorite brands. A good strategy is to provide a reason (claim, experience, emotion) for loyal consumers to stay with your brand.

Get Current Users to Use More.

When there is an opportunity to turn loyal users into creating a potential routine, changing behaviors is more difficult than enticing trial. It’s a good strategy to use when there’s a real benefit to your consumer using more. It’s hard to get them to use more without a real reason.

There has to be a real benefit connected to using more, or it might look hollow/shallow. Driving routines are a challenge. Even with “lifesaving” medicines, the biggest issue is compliance. Find something in their current life to help either ground it or latch onto it.

When I worked on Listerine, people only used mouthwash 20-30 times a year compared to 700+ brushing occasions. So, we focused on connecting rinsing with Listerine to the twice-daily brushing routine.

Enter new categories

You can increase brand profits by entering new categories with an untapped or under-served need. There could be a significant changing demographic that impacts your base.

Or you can translate/transfer your reputation to a new user group. There should be something within your product/brand that helps fuel the brand post-trial. Trial without repeat means you’ll get the spike but then bust. Substantial investment is required. Don’t let it distract from protecting the loyal users.

Create new uses

You can drive brand profits through format line extensions that take your experience or name elsewhere. Can you leverage the same benefit in a convenient “on-the-go” offering? Ensure the current brand is in order before you divert attention, funding, and focus on expansion areas. Importantly, the investment needed could divert from spending on base business.

However, be careful because the legendary stories (Arm and Hammer) don’t come along as much as we hope.

Marketing Excellence

We empower the ambitious to achieve the extraordinary.

Without a doubt, our role at Beloved Brands is to help the ambitious marketers who are trying to improve their marketing skills. Most importantly, we will prepare you so you can reach your full potential in your career. You will learn about strategic thinking, brand positioning, brand plans, marketing execution, and marketing analytics. As well, we provide a suite of marketing tools, templates that will make it easier to do your job, processes that you can follow, and provocative thoughts to trigger your thinking.

Have you gone through an assessment of the marketing skills of your team? Take a look below:

The fundamentals of marketing matter.

Our Beloved Brands marketing training programs cover different streams to suit the type of marketer you are. For instance, our marketing training covers consumer marketing, B2B marketing, and Healthcare marketing.

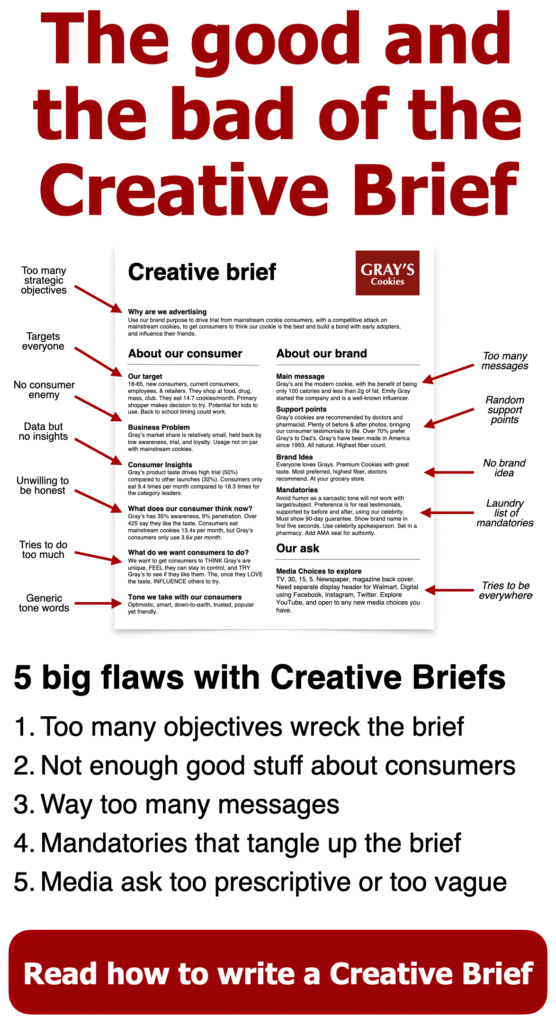

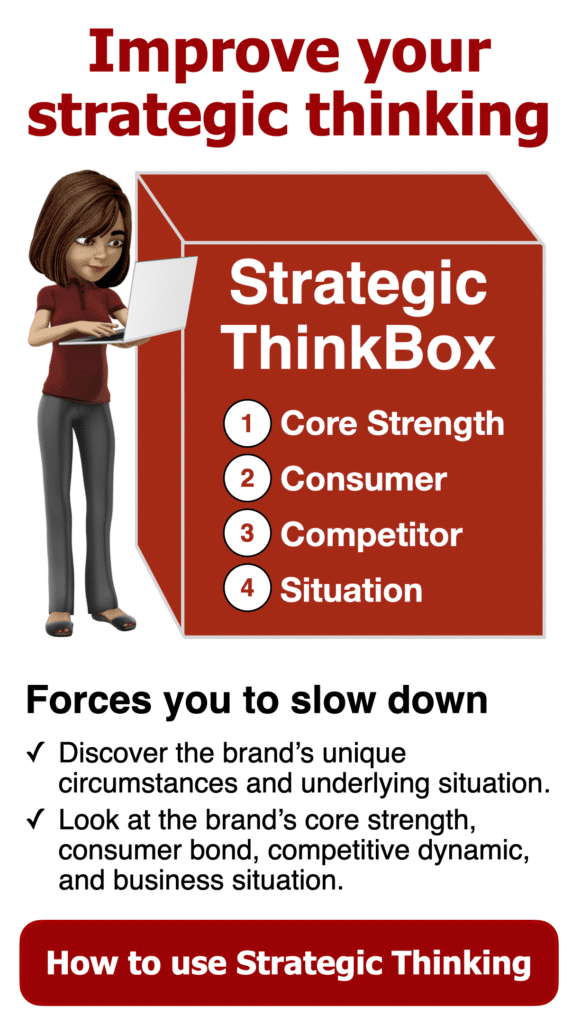

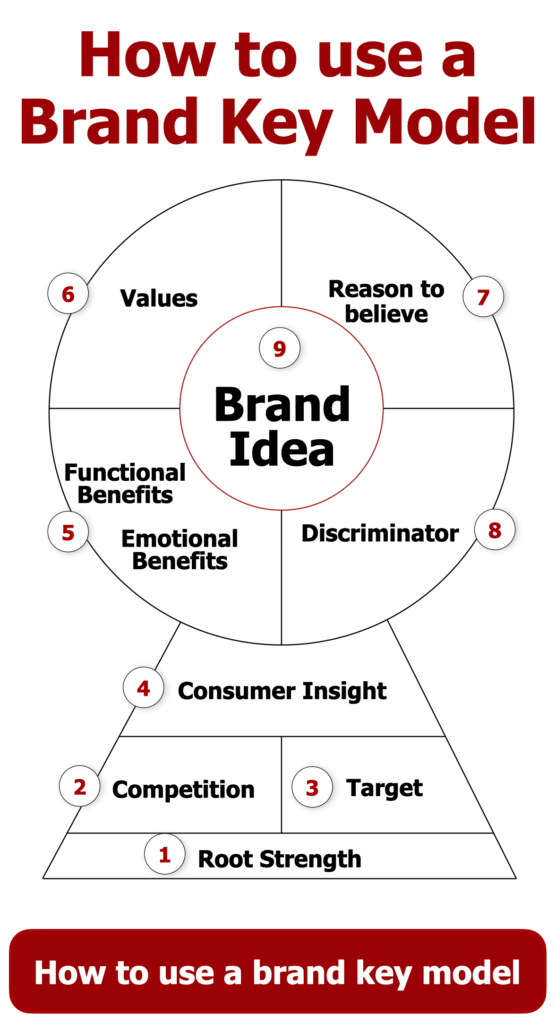

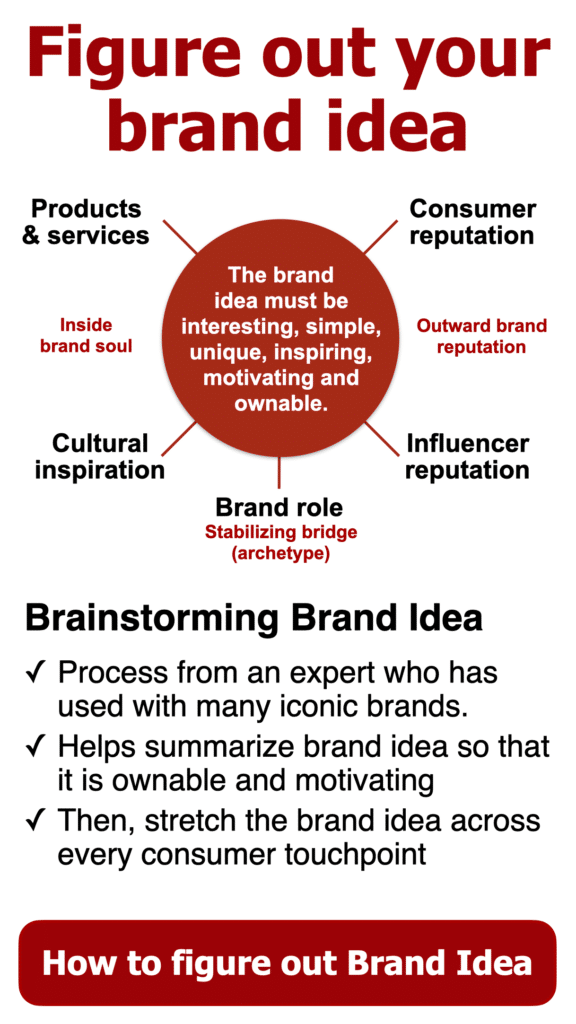

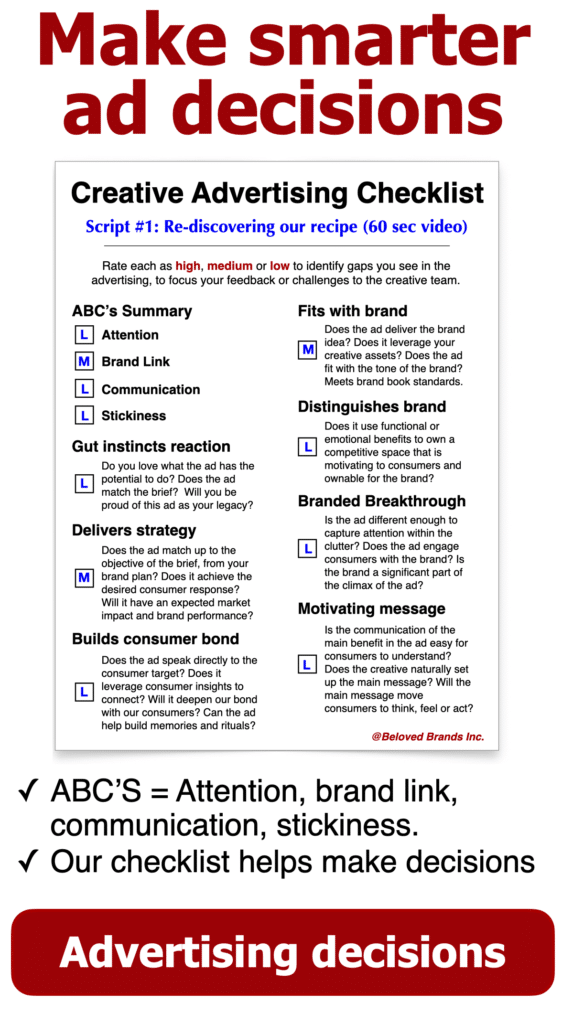

The marketing fundamentals that we show in this article are part of what we use in our marketing training programs. Ambitious marketers will learn about strategic thinking, brand positioning, brand plans, marketing execution, writing creative briefs, advertising decision-making, marketing analytics, and marketing finance.

Importantly, when you invest in our marketing training program, you will help your team gain the marketing skills they need to succeed. Without a doubt, you will see your people make smarter decisions and produce exceptional work that drives business growth.

Finally, I wrote our Beloved Brands playbook to help you build a brand that your consumers will love. If you are a B2B marketer, try our B2B Brands playbook. And, if you are a Healthcare Marketer, try our Healthcare Brands playbook.

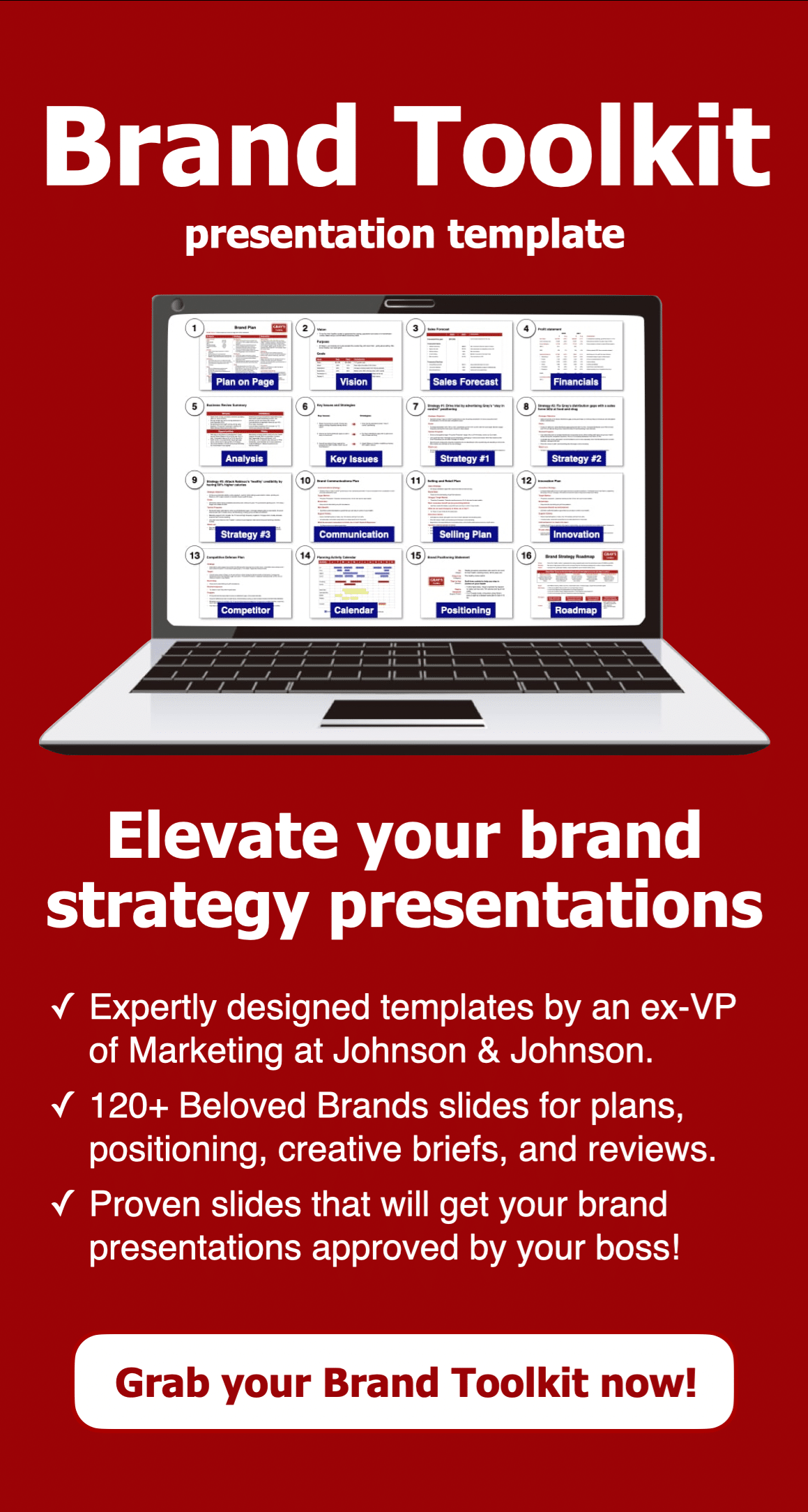

We designed our brand templates to make it easier for you to do your job.

Moreover, we provide brand templates that help you run your brand. For instance, you can find templates for marketing plans, brand positioning, creative briefs, and business reviews. Altogether, we offer brand toolkits with all the presentation slides you need.

If you are looking to make your marketing team smarter, we can help. To get started, email Graham Robertson at [email protected]

What type of marketer are you?

We believe that marketers learn best when they see our marketing concepts applied to brands that look like their own. We have come up with specific examples – consumer, B2B and healthcare – to showcase our marketing tools. Click on the icon below to choose your interest area.

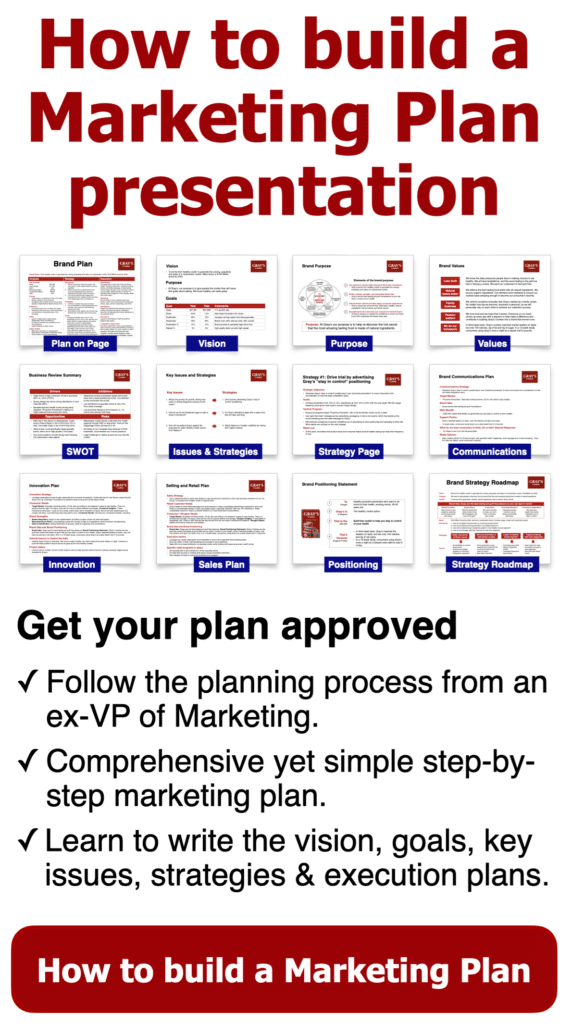

Our brand toolkit for consumer brands is our most comprehensive template helps you communicate your brand plans, brand positioning, business review and creative briefs.

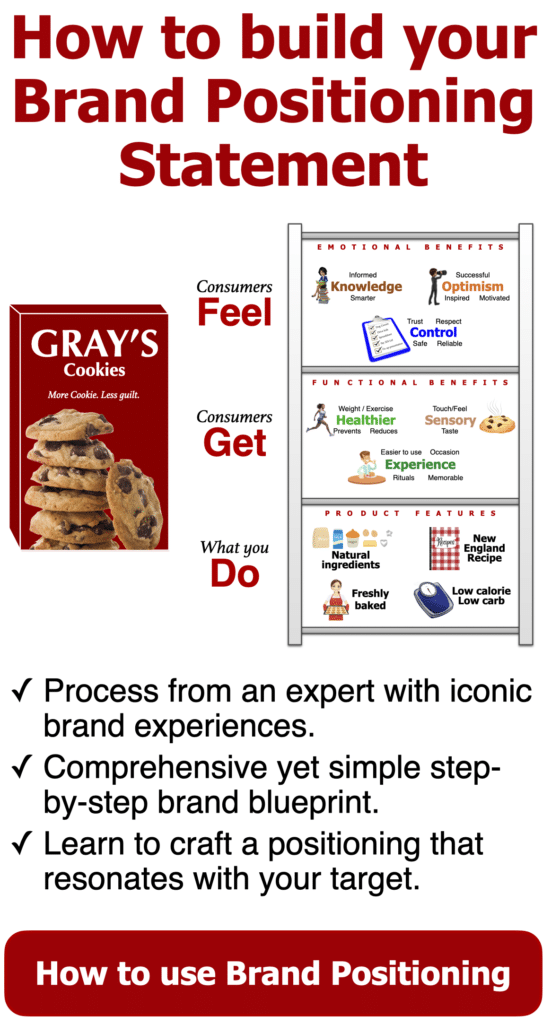

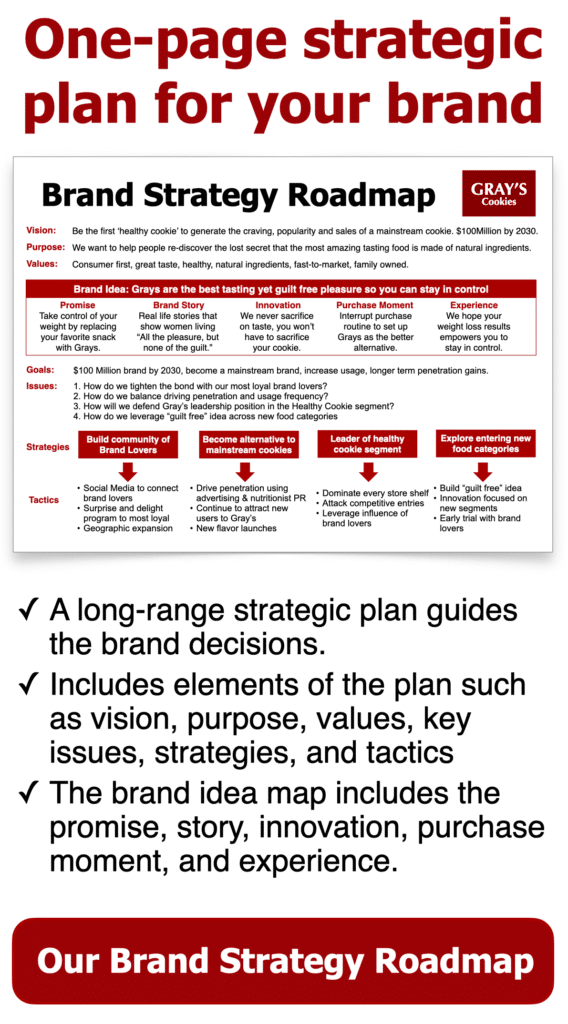

Our brand plan template offers slides for vision, purpose, analysis, key issues, strategies, and execution plans, ensuring a thorough approach to your brand’s development. The brand positioning template guides you through defining your target profile, crafting a brand positioning statement, and developing a unique brand idea, concept, values, story, credo, and creative brief. Finally, our business review template provides slides for in-depth analysis of the marketplace, customers, competitors, channels, and your brand.

Choose the right template for your business needs

Marketing Plans for consumer brands

Combining strategic slides for insightful planning and marketing execution slides for seamless implementation, our templates are designed to propel your brand towards success and help you make a lasting impact in the market.