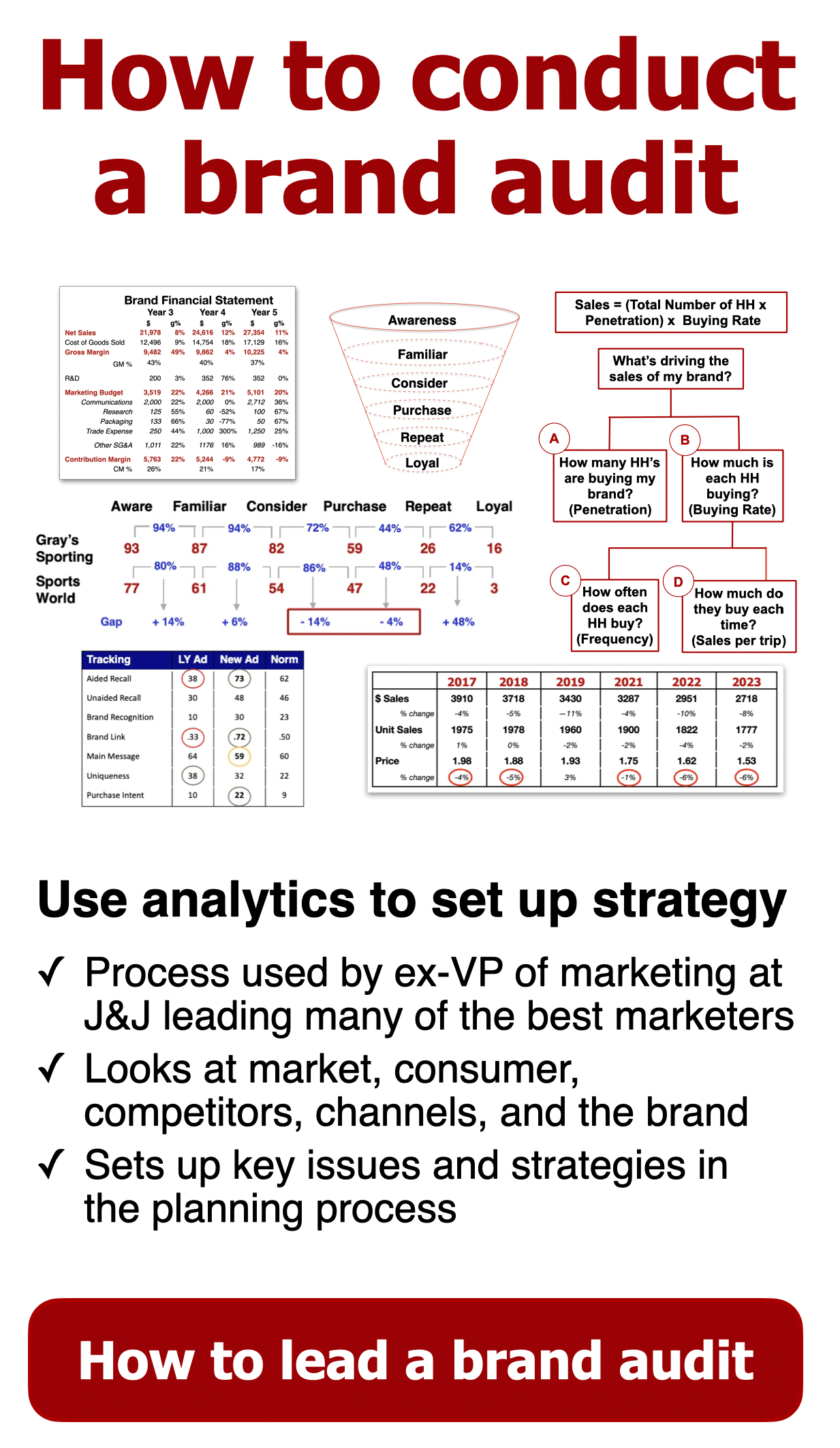

Too many marketers are not taking the time to dig in on the marketing analytics. There is no value in having access to data if you are not using it. The best brand leaders can tell strategic stories through analytics. Conduct a deep-dive business review at least once a year on your brand. Look at it like a brand audit that helps you dig in and see what’s going on. Otherwise, you are negligent and blindly investing your resources without knowing how they are paying back.

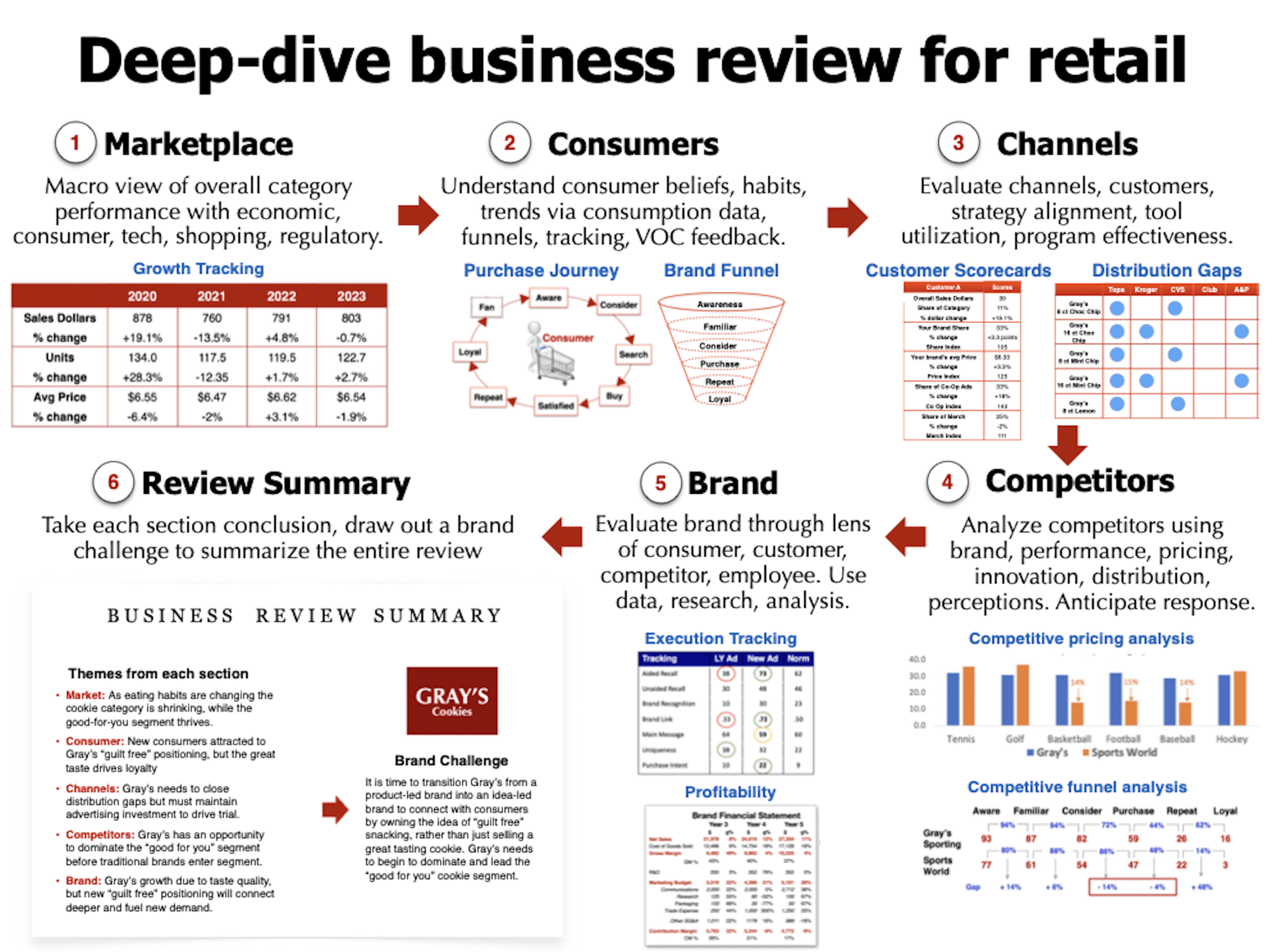

𝗗𝗶𝗴 𝗶𝗻 𝗼𝗻 𝘁𝗵𝗲 𝗳𝗶𝘃𝗲 𝘀𝗽𝗲𝗰𝗶𝗳𝗶𝗰 𝘀𝗲𝗰𝘁𝗶𝗼𝗻𝘀:

1️⃣ Marketplace

2️⃣ Consumers

3️⃣ Channels

4️⃣ Competitors

5️⃣ Brand

We provide a list of ten questions for each of those five sections. Then, draw out conclusions to help set up your brand’s key issues, which you answer in the marketing plan.

The fundamentals of marketing matter

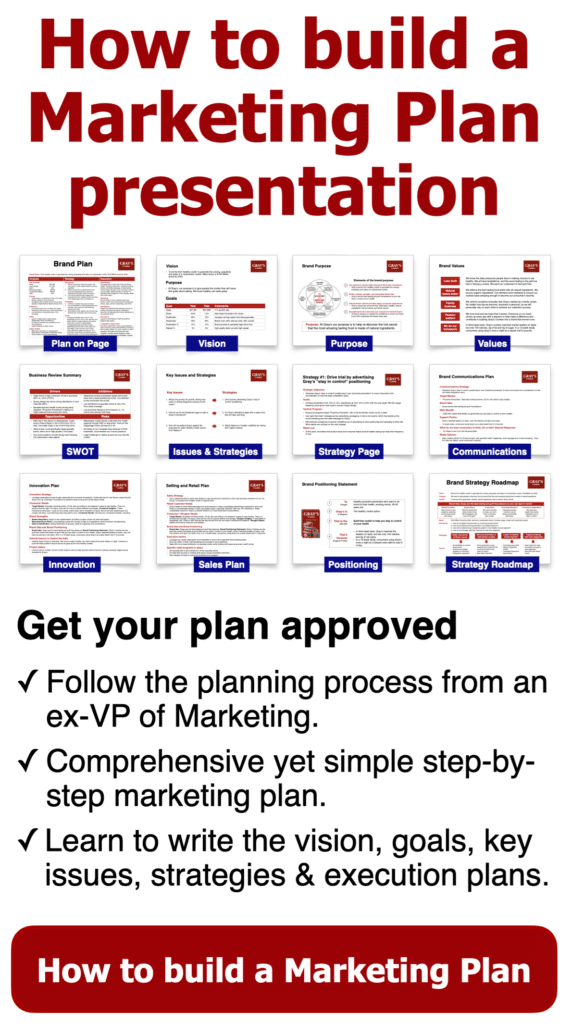

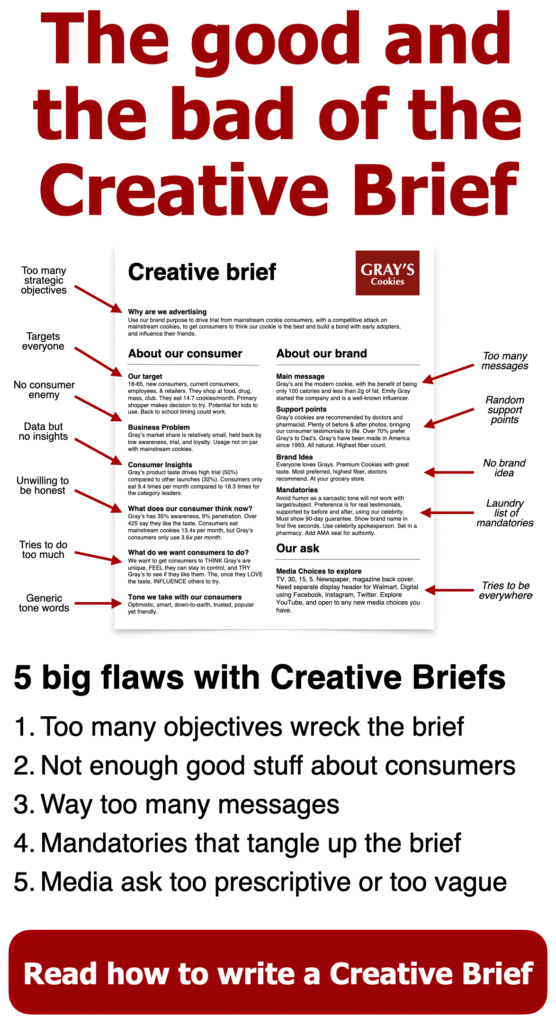

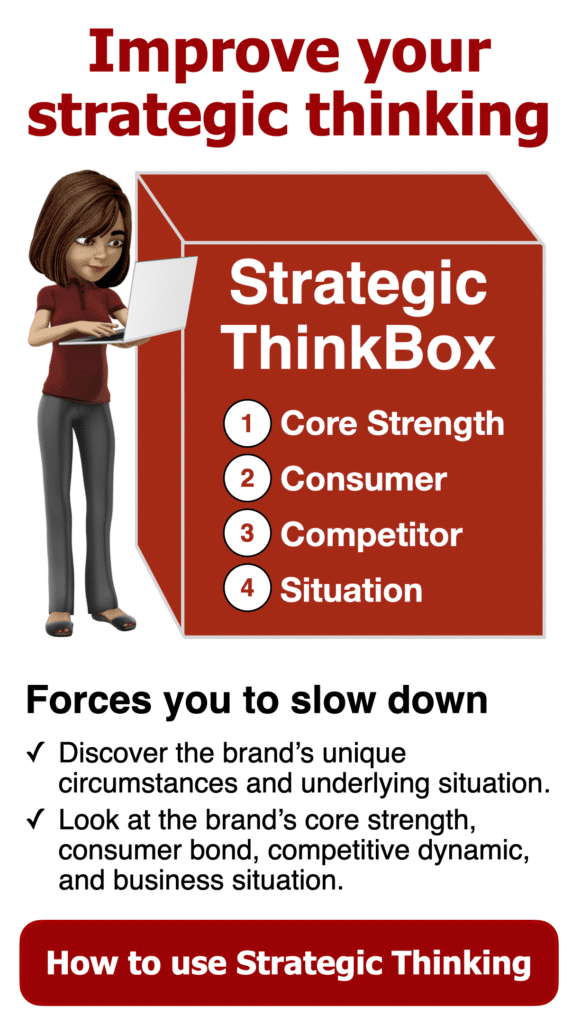

The marketing fundamentals that we show in this article are part of what we use in our marketing training programs. Marketers will learn strategic thinking, brand positioning, brand plans, writing creative briefs, advertising decision-making, marketing analytics, and marketing finance.

The deep-dive business review takes a 360-degree look at your brand

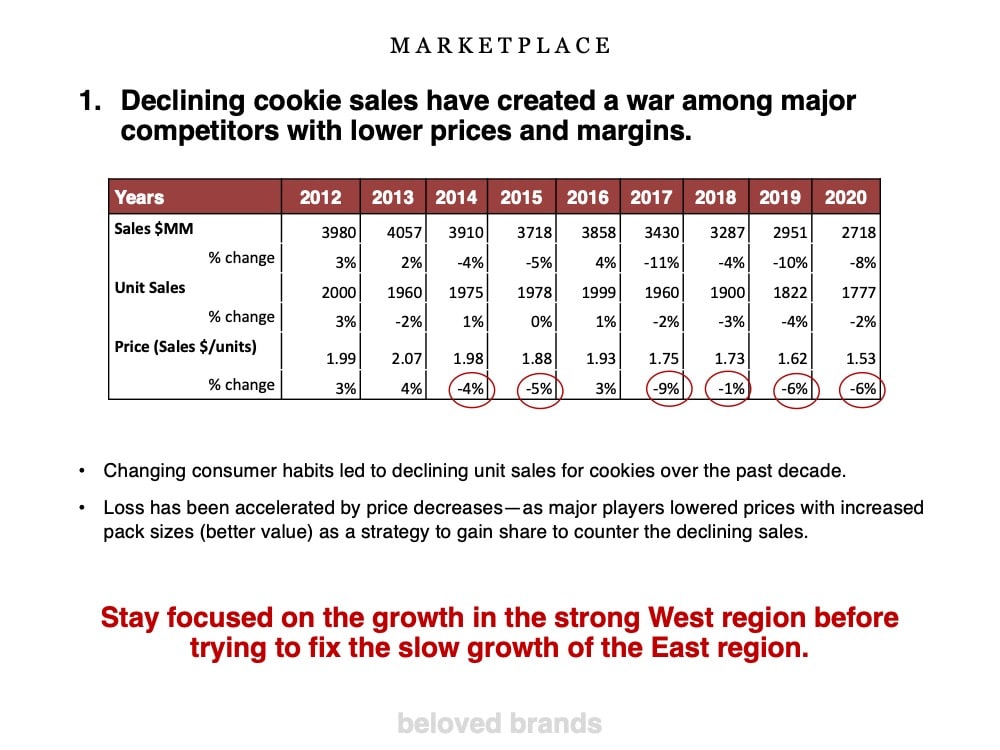

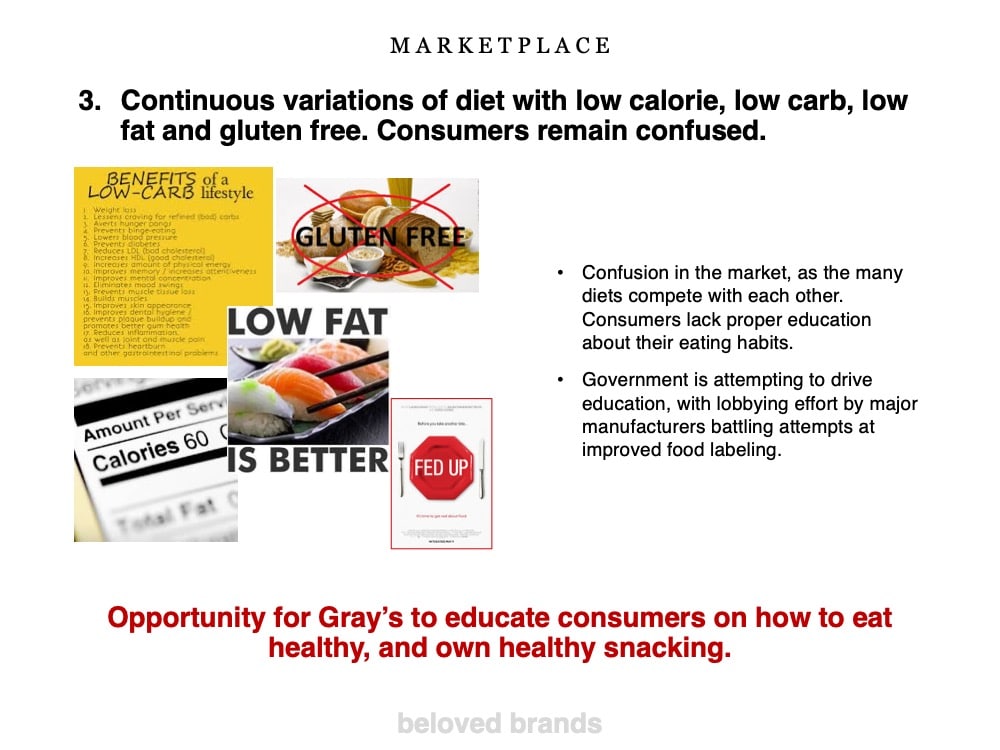

- Marketplace: First, look at the overall category performance to gain a macro view of all significant issues. Then, dig in on the factors impacting category growth, including economic indicators, consumer behavior, technology changes, shopper trends, and political regulations. Also, look at what is happening in related categories, which could impact your category or replicate what you may see next.

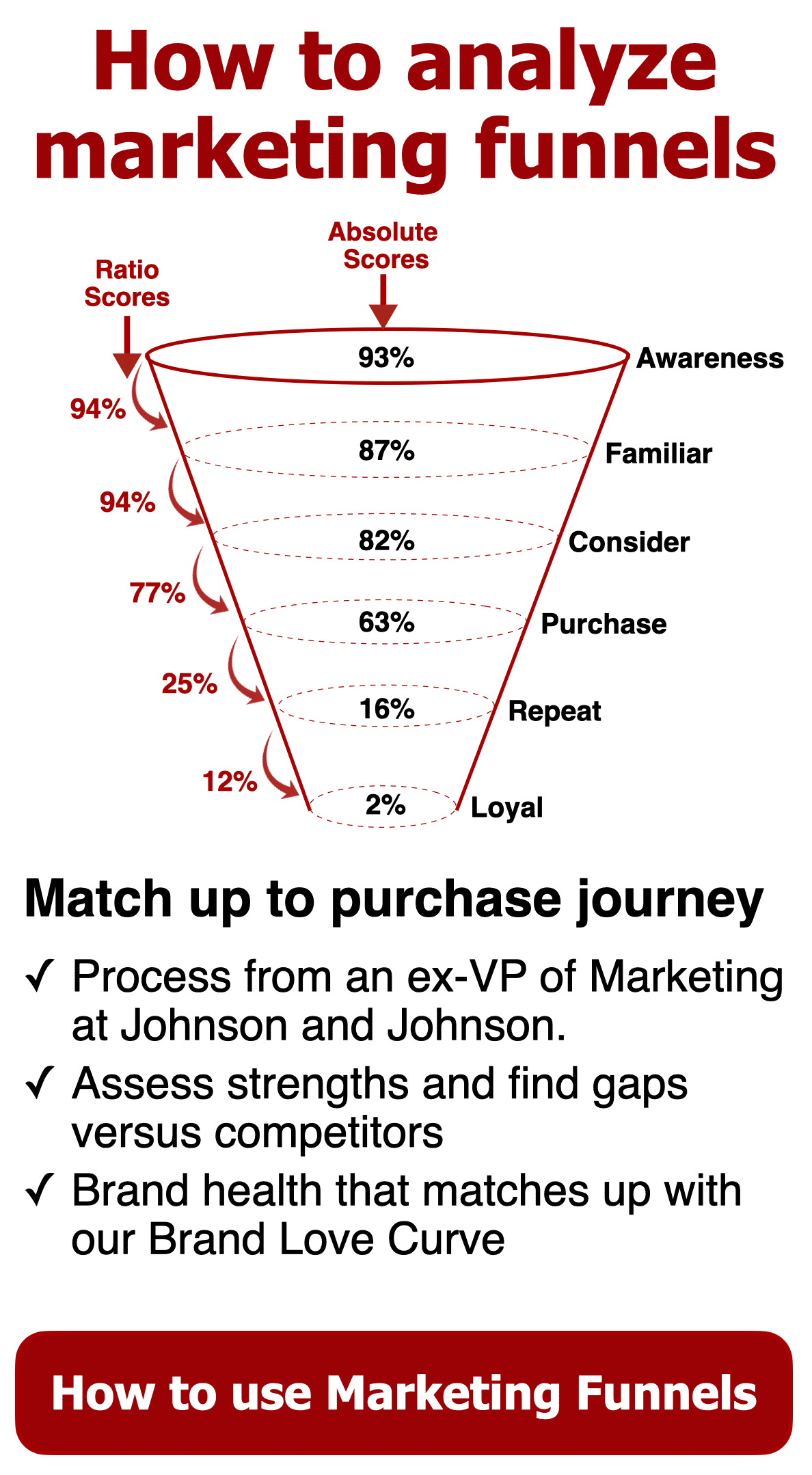

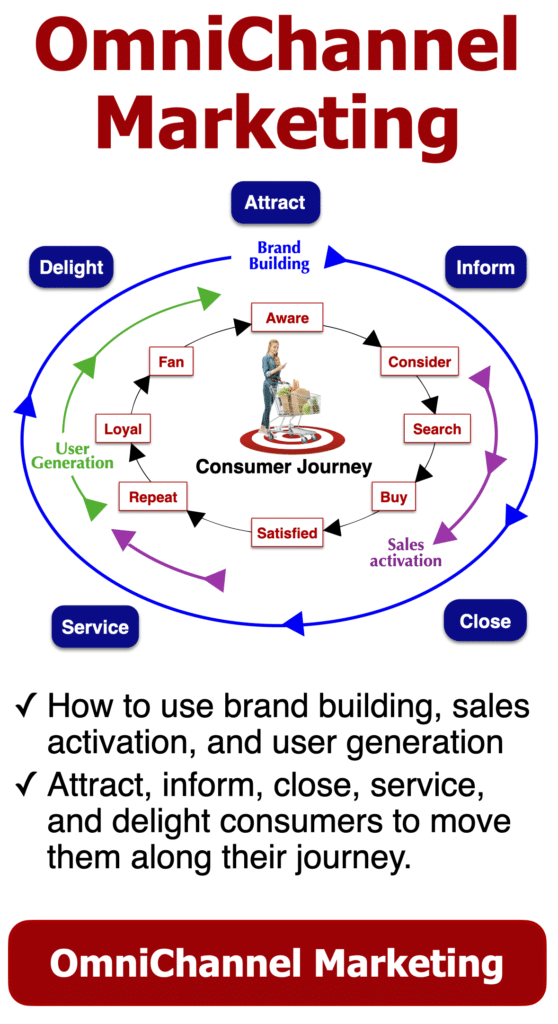

- Consumers: Use marketing analytics to understand your consumer target. Try to understand the consumer’s underlying beliefs, buying habits, growth trends, and critical insights. Use the brand funnel analysis and leaky bucket analysis to uncover how they shop and how they make purchase decisions. And, try to understand what they think when they buy or reject your brand at every stage of the consumer’s purchase journey. Uncover consumer perceptions through tracking data, the voice of the consumer, and market research.

- Channels: Use marketing analytics to assess the performance of all potential distribution channels and the performance of every major retail customer. Understand the strategies, and how well your brand is using their available tools and programs. Your brand must align with your retail customer strategies.

- Competitors: Dissect your closest competitors by looking at their performance indicators, brand positioning, innovation pipeline, pricing strategies, distribution, and the consumer’s perceptions of these brands. To go even deeper, use marketing analytics to map out a strategic brand plan for significant competitors to predict what they might do next. Use that knowledge within your brand plan.

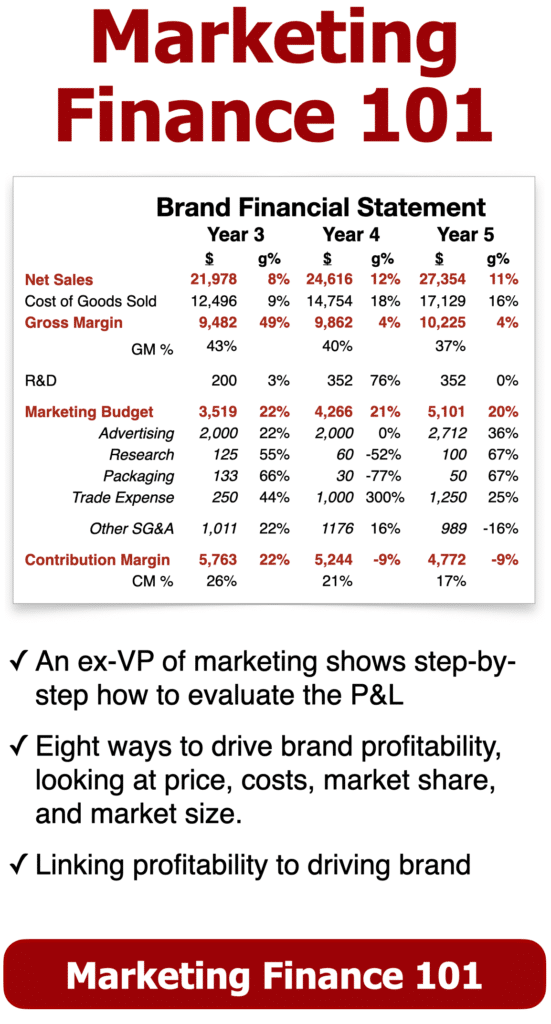

- Brand: Analyze your brand through the lens of consumers, customers, competitors, and employees. Then, use various marketing analytics tools including brand funnel data, market research, marketing program tracking results, pricing analysis, distribution gaps, and financial analysis. Focus on managing your brand’s health and wealth.

Marketing analytics

Summarize your deep-dive business review

To transition from the deep-dive review to your marketing plan, use these four questions.

- First, what’s driving growth? The top factors of strength, positional power, or market inertia, which have a proven link to driving your brand’s growth. Your plan should continue to fuel these growth drivers.

- Next, what’s inhibiting growth? The most significant factors of weakness, unaddressed gaps, or market friction you can prove to be holding back your brand’s growth. Your plan should focus on reducing or reversing these inhibitors to growth.

- Then, look at the opportunities for growth: Look at specific untapped areas in the market, which could fuel your brand’s future growth, based on unfulfilled consumer needs, new technologies on the horizon, potential regulation changes, new distribution channels, or the removal of trade barriers. Your plan should take advantage of these opportunities in the future.

- Finally, what are the threats to future growth: Changing circumstances, including consumer needs, new technologies, competitive activity, distribution changes, or potential barriers, which create potential risks to your brand’s growth. Build your plan to minimize the impact of these risks.

Deep dive business review

Putting together your deep-dive business review

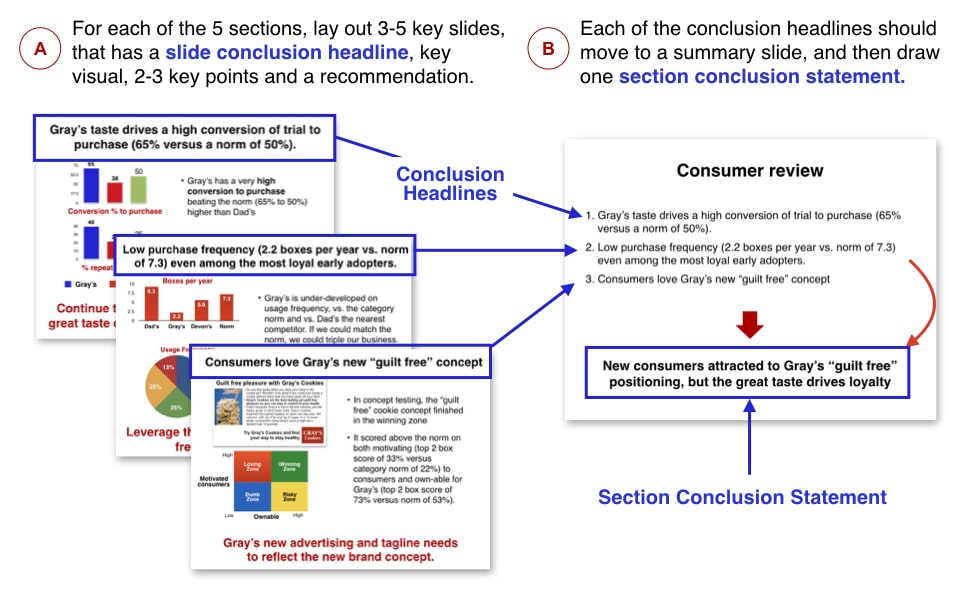

This process assumes you will use your marketing analytics to put together a presentation of 15-20 slides for your management team.

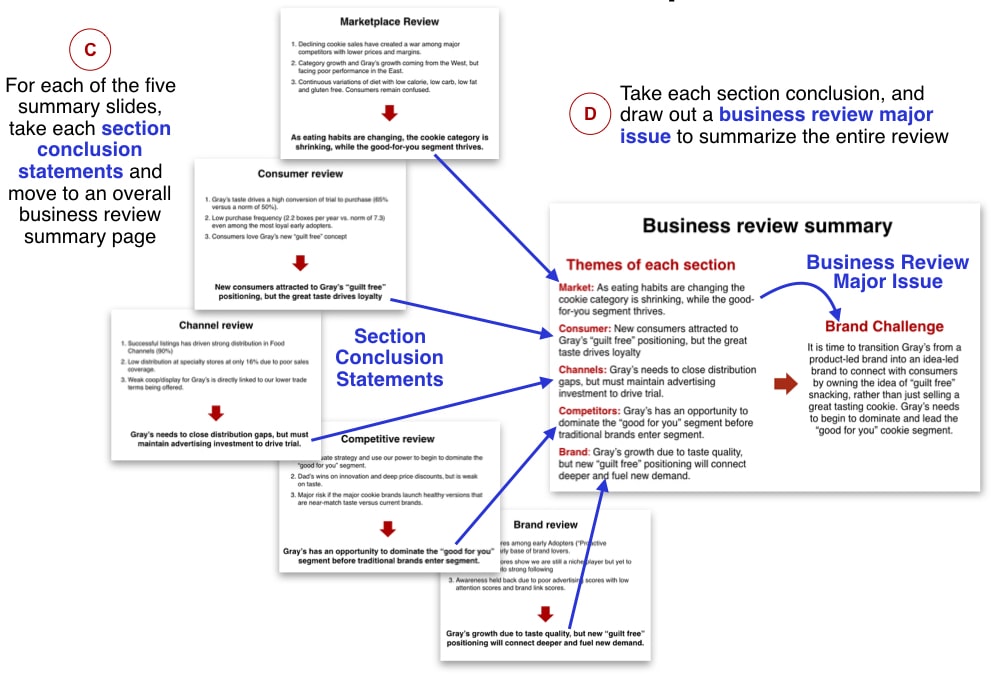

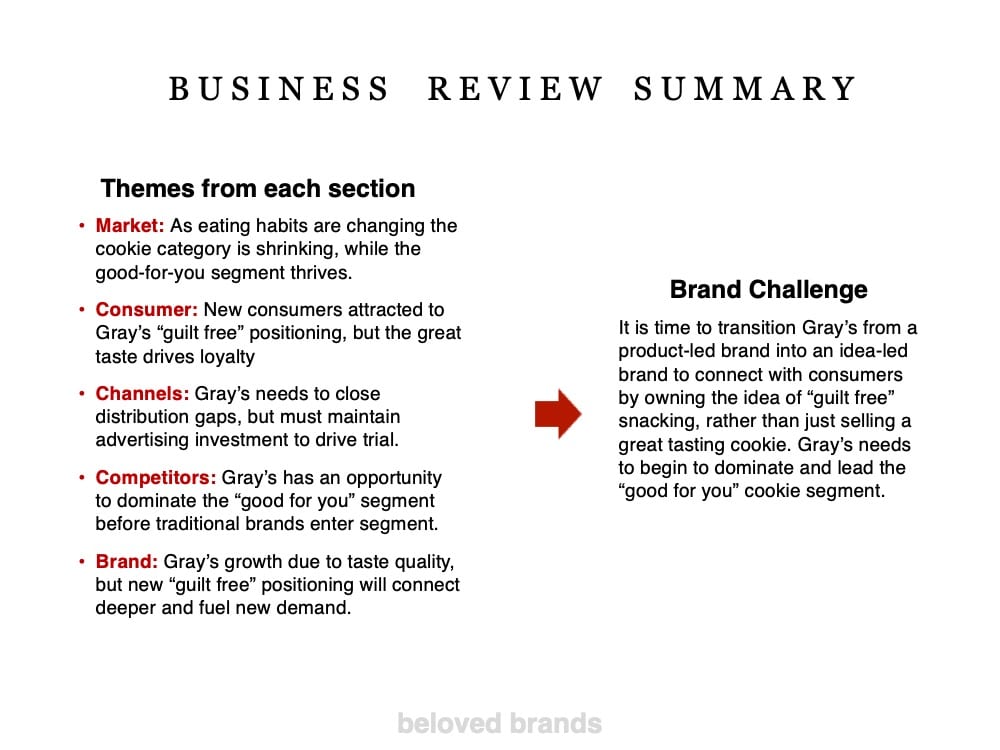

Each of the five sections you go deep on should have 3-5 ideal slides. The conclusion statement at the top of each slide gets carried forward to a summary page for each of the five sections. You then draw out an overall conclusion statement for that section. You will have five conclusion statements, which you bring to the front of your presentation to form an overall summary page. From there, you draw out one major brand challenge you are seeing in the deep dive.

How to build each of the five analytical sections of the deep-dive business review

A: First, for each of the five sections of your deep dive business review, use all the data you have dug into to draw out the three hypothetical conclusions. Then, build one ideal slide for each conclusion, adding the 2-3 critical support points, and layer in the supporting visual charts. This type of analysis is an iterative process where you have to keep modifying the conclusion headline and the support points to ensure they work together.

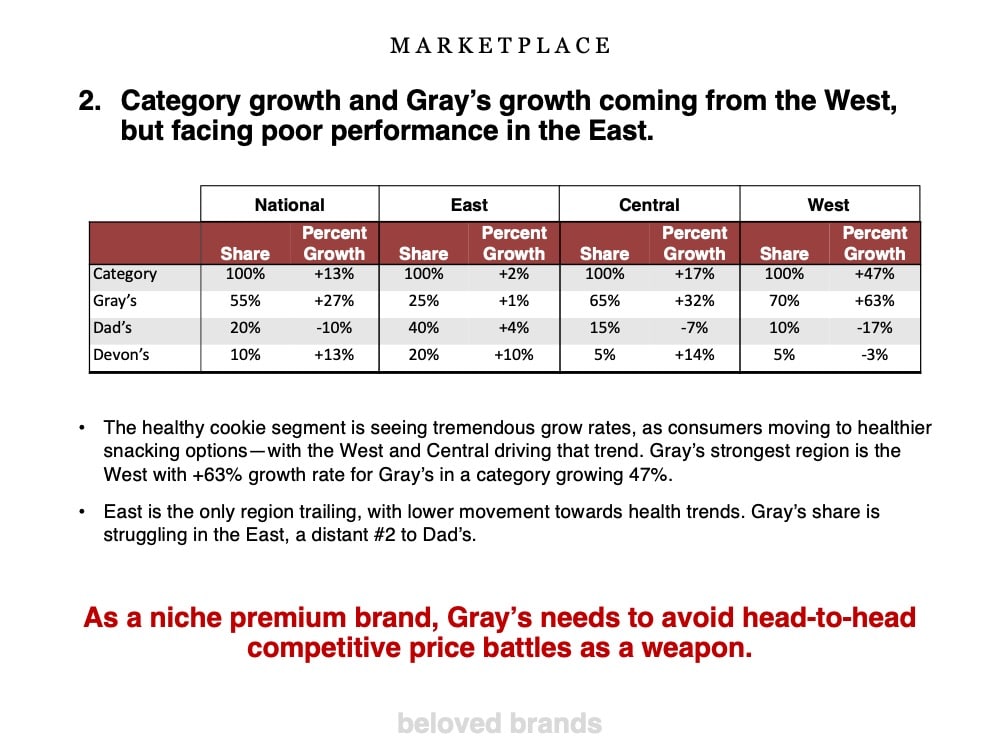

B: Next, once you have nailed the conclusion headline for each page, you should build a summary chart for each of the five sections, which takes those three conclusion statements and builds a section conclusion statement. The example above shows how to do it for the category, which you can replicate for the consumer, channels, competitors, and the brand.

M A R K E T I N G B O O K

beloved brands

The playbook for how to create a brand your consumers will love

Beloved Brands is your secret weapon to guide you through every challenge that you face in managing your brand

Get ready to challenge your mind as we take you on a deep dive to find the most thought-provoking strategic thinking questions that will help you see your brand in a whole new light.

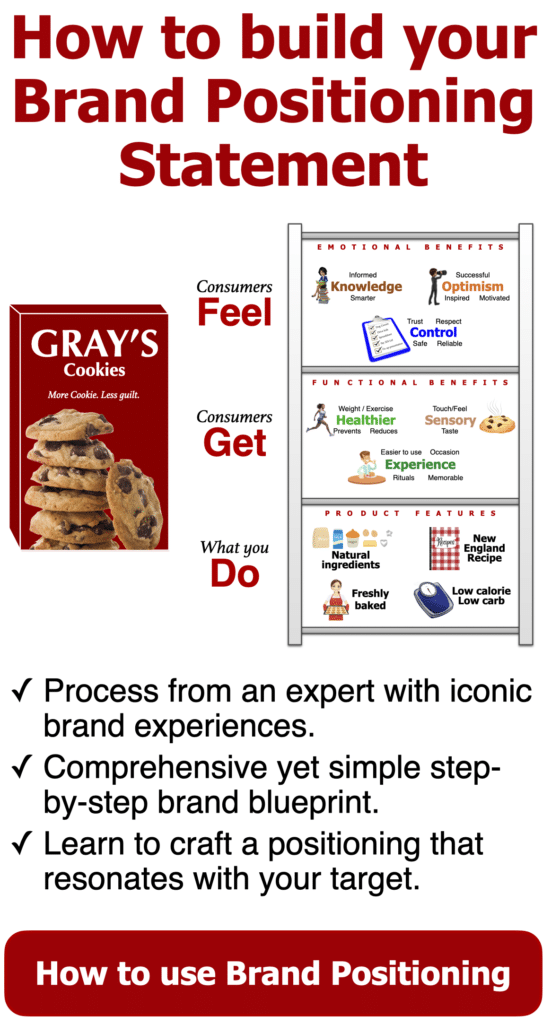

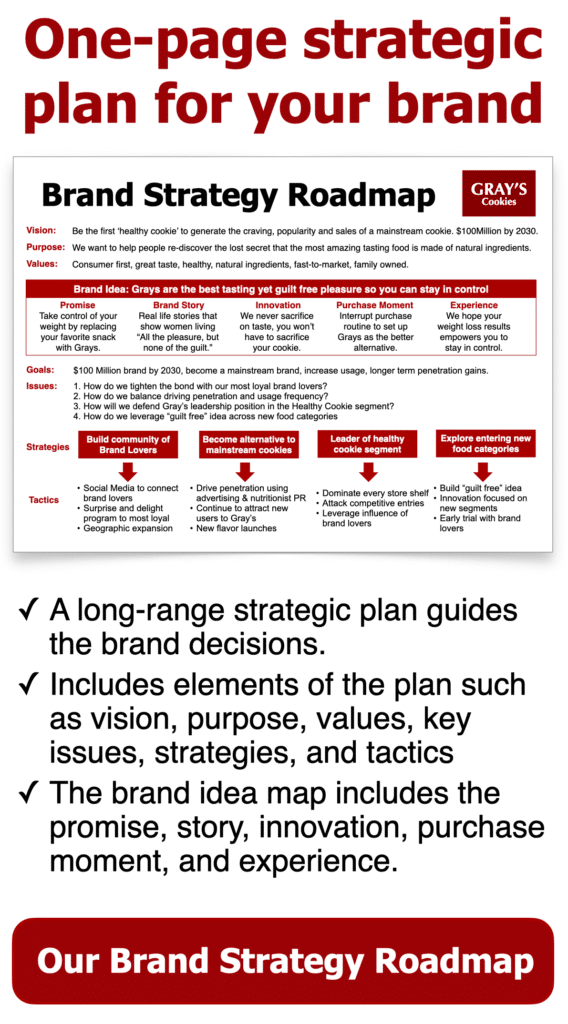

Our unique process for defining your brand positioning will push you to find fresh ideas and new possibilities for how to differentiate your brand based on both functional and emotional benefits.

But we won’t just leave you with ideas – we show how to transform your thinking into action.

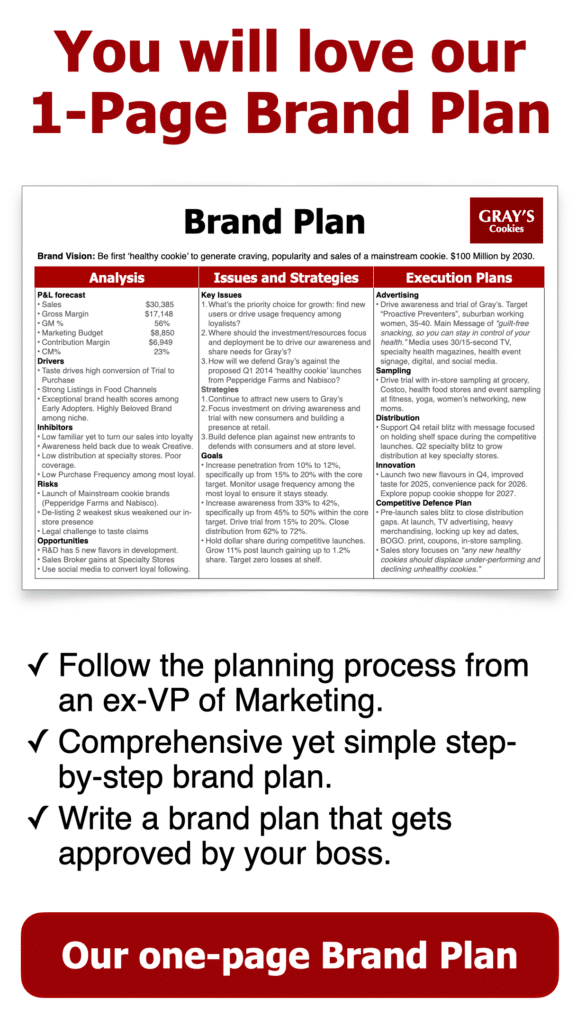

Learn how to write a brand plan that everyone can follow, ensuring that all stakeholders are aligned and contributing to your brand’s success.

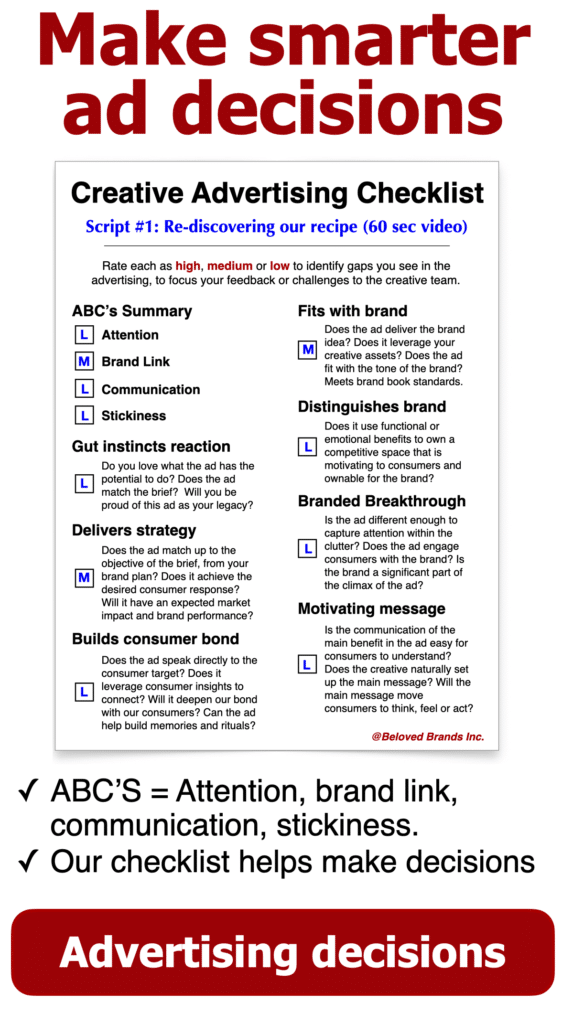

We’ll walk you through the marketing execution process, from writing an inspiring brief to making smart and breakthrough decisions on both creative advertising and innovation.

And when it comes to analyzing your brand’s performance, we’ve got you covered. Learn how to conduct a dive deep audit on your brand to uncover key issues that you never knew existed.

And, don't just take our word for it: our Amazon reviews speak for themselves.

With over 85% of our customers giving us a glowing five-star rating and an overall rating of 4.8 out of 5.0, we know we’re doing something right. And with numerous weeks as the #1 bestseller in brand management, you can trust that we have the experience and expertise to help you achieve success.

"The cheat code for brand managers!"

“It is without a doubt the most practical book for those who want to follow brand management that I have ever read in my life! Beloved Brands is written by a real, experienced marketeer for marketers. This book contains methodologies, tools, templates and thought processes that Graham actually used and uses in his career.”

Summarizing the deep-dive business review

C: For each of the five sections, take each section conclusion statement, move them to an overall business review summary slide, and draw one big summary statement for each of the five sections.

D: Finally, use those section conclusion statements to draw out an overall business review major issue, which summarizes everything in the analysis.

Analytical slides

How to build the ideal analytical slide

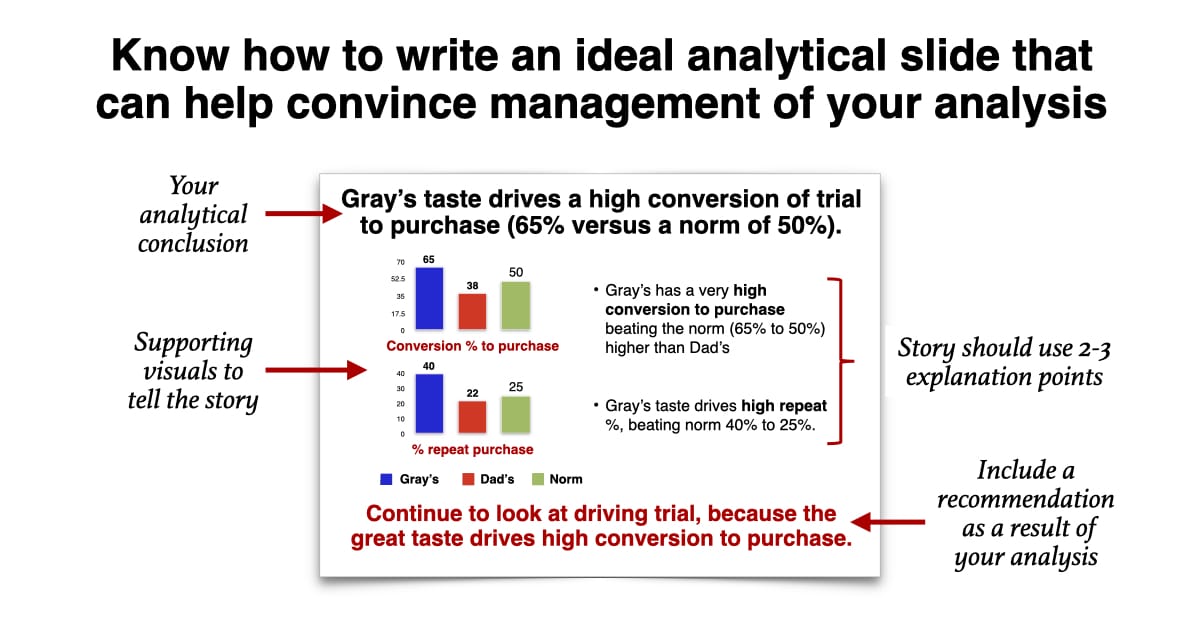

When telling your analytical story through a deep-dive business review presentation, start every slide with an analytical conclusion statement as your headline, then have 2-3 key analytical support points for your conclusion. Provide a supporting visual or graph to show the thinking underneath the analysis. Finally, you must include an impact recommendation on every slide. Never tell your management a data point without attaching your conclusion of what to do with that data.

Business review example

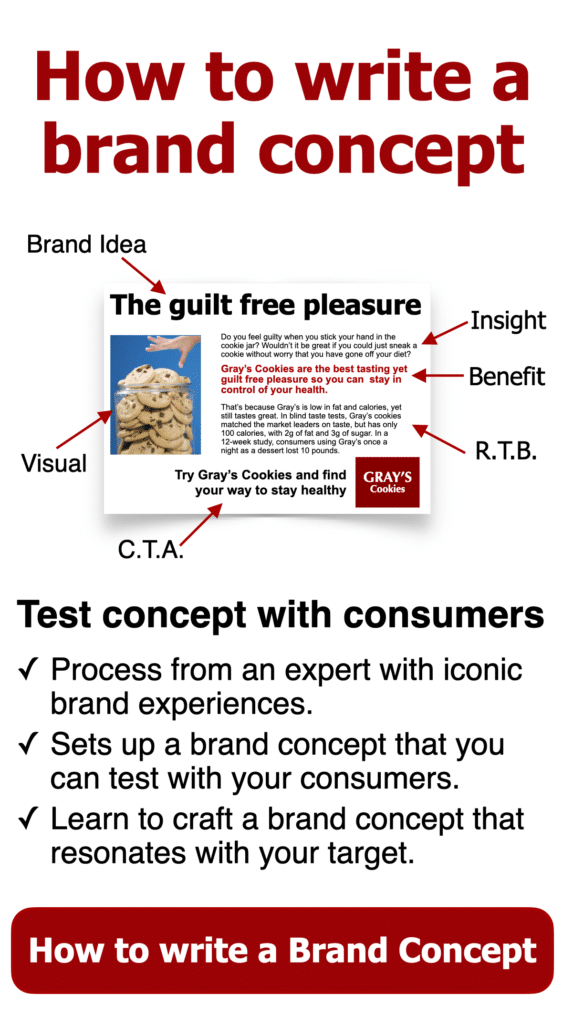

Example slides for a Business Review for Gray's Cookies

To illustrate, click to zoom in.

Business review template

You can download our business review templates to work on your brand

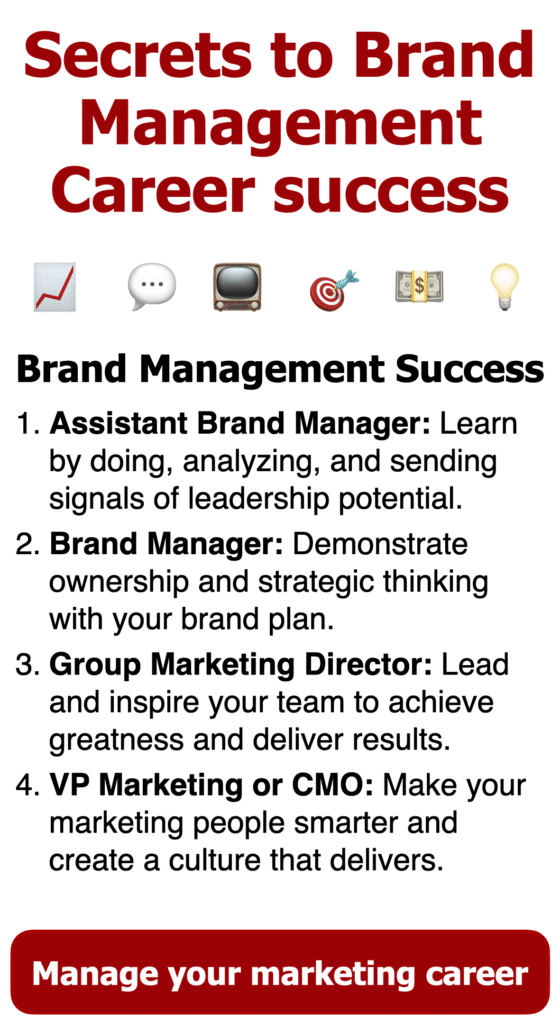

Marketing Career

How to manage your marketing career from ABM to CMO

At every level of your marketing career, you have to adjust to the new role. Brand Managers fail when they keep acting like ABMs and Directors fail when they keep acting like Brand Managers and VPs fail when they don’t know what to do. In a classic marketing team, the four key roles are Assistant Brand Manager up to Brand Manager then up to Marketing Director and on to the VP/CMO role. The use of marketing analytics is something you need to learn early and continue to refine at each level.

Marketing Excellence

We empower the ambitious to achieve the extraordinary

Without a doubt, I see our role is to help the ambitious marketers who are trying to improve their skills. In most cases, we hope to challenge your thinking so you become a smarter marketer. Most importantly, our purpose is to find ways to help you reach your full potential. We provide the tools, templates, processes, and provocative thoughts.

Undoubtably, everyone learns their own way. With this in mind, we provide numerous brand stories to engage on our Beloved Brands site.

Moreover, we provide brand templates that help you run your brand. For instance, you can find templates for marketing plans, brand positioning, creative briefs, and business reviews. Altogether, we offer brand toolkits with all the presentation slides you need.

Our marketing training programs cover different streams to suit the type of marketer you are. For instance, our marketing training covers consumer marketing, B2B marketing, and Healthcare marketing.

Finally, I wrote our brand playbooks to help you build a brand that your consumers will love.

The fundamentals of marketing matter

The marketing fundamentals that we show in this article are part of what we use in our marketing training programs. Ambitious marketers will learn about strategic thinking, brand positioning, brand plans, writing creative briefs, advertising decision-making, marketing analytics, and marketing finance.

Importantly, when you invest in our marketing training program, you will help your team gain the marketing skills they need to succeed. Without a doubt, you will see your people make smarter decisions and produce exceptional work that drives business growth.

Brand management templates

Our brand management templates includes PowerPoint presentations for brand plans, brand positioning, brand reviews, and creative briefs. Most importantly, our brand management templates reflect the tools in our brand playbooks, Beloved Brands, and B2B Brands.

In addition, you can gain access to each type of format for consumer-facing brands, B2B, and healthcare. To help, we start with blank slides with key definitions. Then, we add a completed PowerPoint slide presentation using our relevant brand case studies.